Deep-pocketed investors have adopted a bearish approach towards Amgen (NASDAQ:AMGN), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMGN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Amgen. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 62% bearish. Among these notable options, 6 are puts, totaling $287,160, and 2 are calls, amounting to $67,000.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $315.0 and $355.0 for Amgen, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $315.0 and $355.0 for Amgen, spanning the last three months.

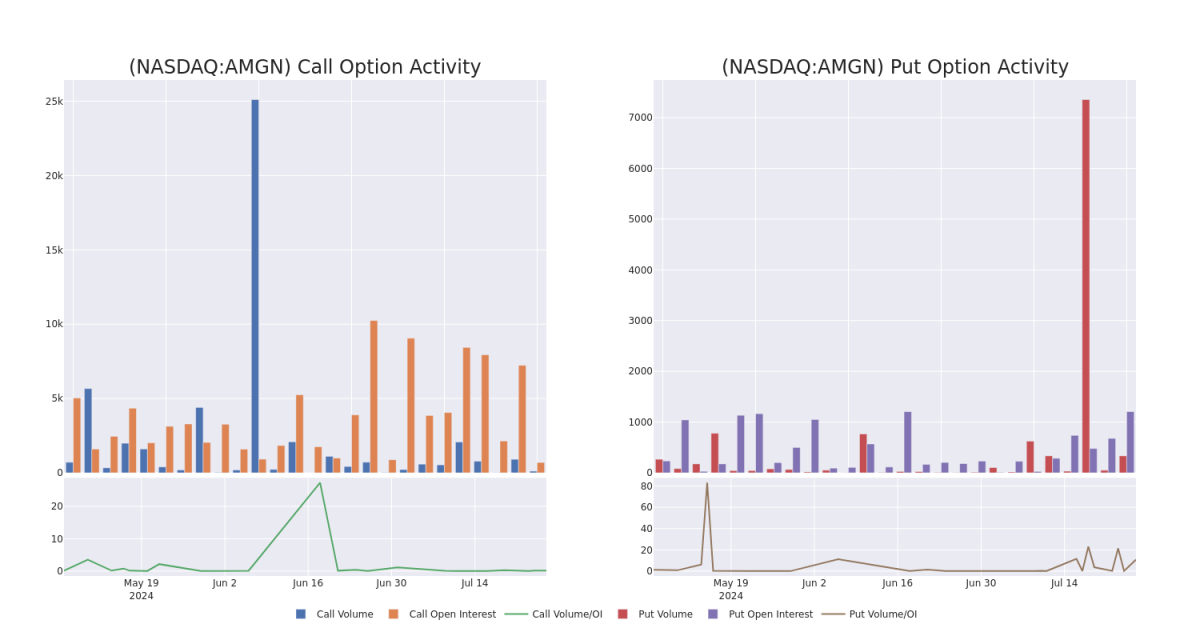

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Amgen's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amgen's whale activity within a strike price range from $315.0 to $355.0 in the last 30 days.

Amgen Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| AMGN | PUT | SWEEP | BEARISH | 10/18/24 | $12.5 | $12.4 | $12.5 | $325.00 | $67.4K | 789 | 98 |

| AMGN | PUT | TRADE | BEARISH | 01/16/26 | $31.75 | $30.3 | $31.75 | $320.00 | $63.5K | 162 | 25 |

| AMGN | PUT | TRADE | BEARISH | 03/21/25 | $30.55 | $30.5 | $30.55 | $340.00 | $61.1K | 2 | 20 |

| AMGN | PUT | TRADE | BEARISH | 10/18/24 | $14.45 | $14.45 | $14.45 | $330.00 | $36.1K | 253 | 50 |

| AMGN | CALL | SWEEP | BULLISH | 08/09/24 | $3.45 | $2.57 | $3.45 | $355.00 | $34.5K | 16 | 100 |

About Amgen

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

Current Position of Amgen

- Currently trading with a volume of 164,369, the AMGN's price is down by -0.04%, now at $334.17.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 11 days.

Expert Opinions on Amgen

2 market experts have recently issued ratings for this stock, with a consensus target price of $321.5.

- An analyst from Argus Research has decided to maintain their Buy rating on Amgen, which currently sits at a price target of $340.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Amgen, which currently sits at a price target of $303.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

資金力のある投資家は、アムジェン(NASDAQ:AMGN)に対して弱気なアプローチをとっています。これは市場関係者が無視してはならないことです。Benzingaでのパブリックオプションの記録を追跡したところ、本日、この重要な動きが明らかになりました。これらの投資家の身元は不明のままですが、AMGNのこのような大幅な動きは、通常、何か大きなことが起こりそうなことを示唆しています。

私たちは今日、ベンジンガのオプションスキャナーがアムジェンの8つの特別なオプション活動を強調したときの観察からこの情報を収集しました。このレベルの活動は普通ではありません。

これらのヘビー級投資家の全体的なムードは分かれていて、37%が強気、62%が弱気です。これらの注目すべきオプションのうち、6つは合計287,160ドルのプットで、2つは67,000ドルのコールです。

予測価格目標

取引量と建玉を評価した結果、主要な市場動向者は、過去3か月間、アムジェンの価格帯に315.0ドルから355.0ドルの間の価格帯に注目していることがわかりました。

取引量と建玉を評価した結果、主要な市場動向者は、過去3か月間、アムジェンの価格帯に315.0ドルから355.0ドルの間の価格帯に注目していることがわかりました。

取引量と建玉の傾向

出来高と建玉を調べることは、株式のデューデリジェンスを行うための洞察力に富んだ方法です。

このデータは、特定の行使価格におけるアムジェンのオプションの流動性と利息を追跡するのに役立ちます。

以下では、過去30日間の行使価格315.0ドルから355.0ドルの範囲でのアムジェンのすべてのクジラ活動について、コールとプットの取引量と建玉の変化をそれぞれ観察できます。

アムジェン・オプションの活動分析:過去30日間

注目すべきオプションアクティビティ:

| シンボル | プット/コール | 取引タイプ | センチメント | 経験値。日付 | 聞いてください | 入札 | 価格 | ストライクプライス | 取引価格合計 | オープンインタレスト | ボリューム |

|---|

| AMGN | 置く | 掃く | クマのような | 10/18/24 | 12.5ドルです | 12.4ドル | 12.5ドルです | 325.00ドルです | 67.4,000ドルです | 789 | 98 |

| AMGN | 置く | 貿易 | クマのような | 01/16/26 | 31.75ドル | 30.3ドル | 31.75ドル | 320.00 ドル | 63.5万ドル | 162 | 25 |

| AMGN | 置く | 貿易 | クマのような | 03/21/25 | 30.55ドル | 30.5ドル | 30.55ドル | 340.00 ドル | 61.1万ドル | 2 | 20 |

| AMGN | 置く | 貿易 | クマのような | 10/18/24 | 14.45ドルです | 14.45ドルです | 14.45ドルです | 330.00 ドル | 361万ドル | 253 | 50 |

| AMGN | 呼び出します | 掃く | 強気 | 08/09/24 | 3.45ドルです | 2.57ドルです | 3.45ドルです | 355.00 ドル | 34.5万ドル | 16 | 100 |

アムジェンについて

アムジェンは、バイオテクノロジーを基盤とするヒト治療薬のリーダーです。主力薬には、赤血球ブースターのエポゲンとアラネスプ、免疫システムブースターのニューポゲンとニューラスタ、炎症性疾患用のエンブレルとオテズラがあります。アムジェンは2006年に最初のがん治療薬であるベクティビックスを発売し、骨強化薬Prolia/Xgeva(2010年承認)とEvenity(2019年)を販売しています。Onyxの買収により、Kyprolisによる同社の腫瘍治療ポートフォリオが強化されました。最近発売された商品には、Repatha(コレステロールを下げる)、Aimovig(片頭痛)、Lumakras(肺がん)、Tezspire(喘息)などがあります。2023年のHorizonの買収により、甲状腺眼疾患治療薬テペッツァなど、いくつかの希少疾患治療薬が登場します。アムジェンは、バイオシミラーのポートフォリオも拡大しています。

アムジェンの現在の位置

- 現在、164,369の取引量で取引されているAMGNの価格は -0.04% 下落し、現在は334.17ドルです。

- RSIの測定値は、その株が現在買われ過ぎの可能性があることを示唆しています。

- 決算発表は11日後に予定されています。

アムジェンに関する専門家の意見

最近、2人の市場専門家がこの株の格付けを発表しました。コンセンサス目標価格は321.5ドルです。

- アーガス・リサーチのアナリストは、アムジェンの買いの格付けを維持することを決定しました。現在の目標価格は340ドルです。

- モルガン・スタンレーのアナリストは、アムジェンのイコール・ウェイト・格付けを維持することを決定しました。現在の目標価格は303ドルです。

オプションは単なる株取引に比べてリスクの高い資産ですが、利益の可能性は高いです。本格的なオプショントレーダーは、毎日自分自身を教育し、取引のスケールインとスケールアウトを行い、複数の指標に従い、市場を綿密に追跡することで、このリスクを管理します。

取引量と建玉を評価した結果、主要な市場動向者は、過去3か月間、アムジェンの価格帯に315.0ドルから355.0ドルの間の価格帯に注目していることがわかりました。

取引量と建玉を評価した結果、主要な市場動向者は、過去3か月間、アムジェンの価格帯に315.0ドルから355.0ドルの間の価格帯に注目していることがわかりました。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $315.0 and $355.0 for Amgen, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $315.0 and $355.0 for Amgen, spanning the last three months.