Alibaba Group Holding Ltd (NYSE:BABA) shares surged the most in two months as investors welcomed the company's new strategy to increase merchant service fees.

Following the announcement of this new revenue model, the stock jumped as much as 5.8% in Hong Kong and close to 3% in the U.S. market.

Starting in September, Alibaba will implement a basic software service fee of 0.6% on confirmed transactions for vendors using its Tmall and Taobao platforms, Bloomberg reports. According to an insider, the company may waive this fee for smaller merchants.

Also Read: Alibaba's Taobao Introduces Free Overseas Shipping to Compete with Rivals

Also Read: Alibaba's Taobao Introduces Free Overseas Shipping to Compete with Rivals

This new fee structure will significantly boost Alibaba's core merchant revenue, adding to the stock's positive outlook.

Jefferies Financial Group analysts noted that Alibaba earns most of its Taobao and Tmall revenue through customer management fees, which merchants pay to advertise and tailor their product offerings.

Currently, Alibaba charges Tmall merchants a fixed annual fee, which will cease to exist once the new policy takes effect on September 1.

The shift to a percentage-based fee structure aligns Alibaba with other major e-commerce platforms, including PDD Holdings Inc (NASDAQ:PDD), JD.com Inc (NASDAQ:JD), and ByteDance.

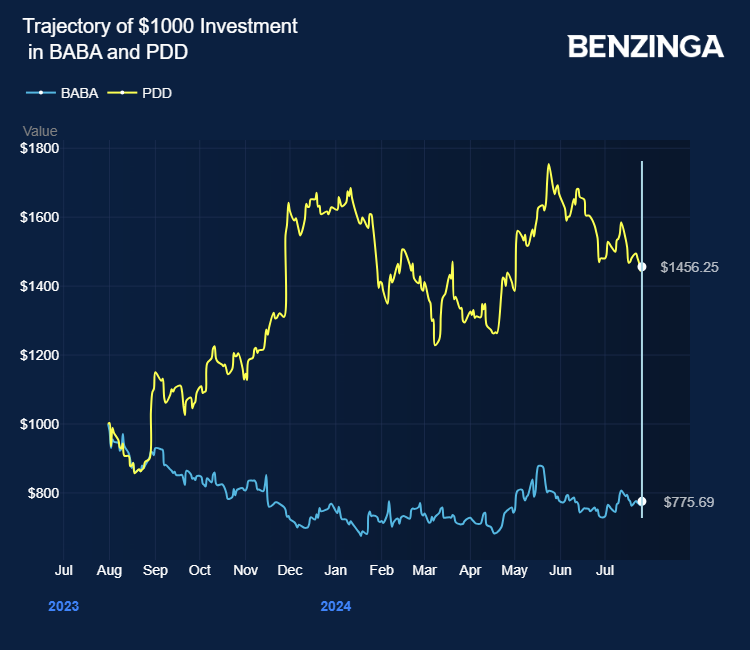

Alibaba stock lost over 25% as it battled intense domestic e-commerce rivalry in a weak economy. Investors can gain exposure to the stock through Avantis Emerging Markets Equity ETF (NYSE:AVEM) and Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ).

Price Action: BABA shares traded higher by 3.06% at $78.87 premarket at the last check on Monday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy Alibaba