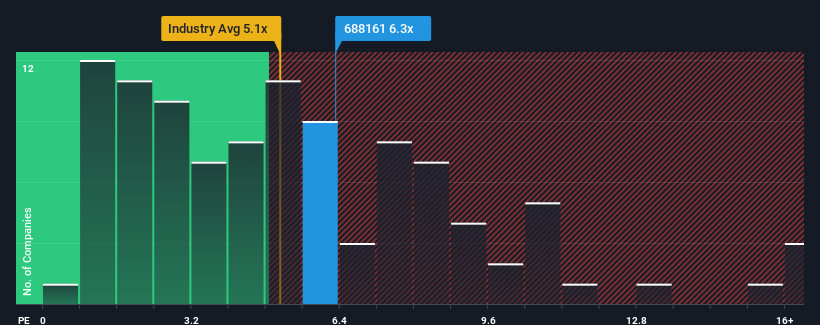

You may think that with a price-to-sales (or "P/S") ratio of 6.3x Shandong Weigao Orthopaedic Device Co., Ltd (SHSE:688161) is a stock to potentially avoid, seeing as almost half of all the Medical Equipment companies in China have P/S ratios under 5.1x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Shandong Weigao Orthopaedic Device's P/S Mean For Shareholders?

Shandong Weigao Orthopaedic Device hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Shandong Weigao Orthopaedic Device will help you uncover what's on the horizon.How Is Shandong Weigao Orthopaedic Device's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Shandong Weigao Orthopaedic Device's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's top line. As a result, revenue from three years ago have also fallen 37% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 26% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 27%, which is not materially different.

With this in consideration, we find it intriguing that Shandong Weigao Orthopaedic Device's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting Shandong Weigao Orthopaedic Device's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

Before you take the next step, you should know about the 1 warning sign for Shandong Weigao Orthopaedic Device that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com