For many, the main point of investing is to generate higher returns than the overall market. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Jiangsu Broadcasting Cable Information Network Corporation Limited (SHSE:600959), since the last five years saw the share price fall 37%. And we doubt long term believers are the only worried holders, since the stock price has declined 24% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 12% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 11% in the same timeframe.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

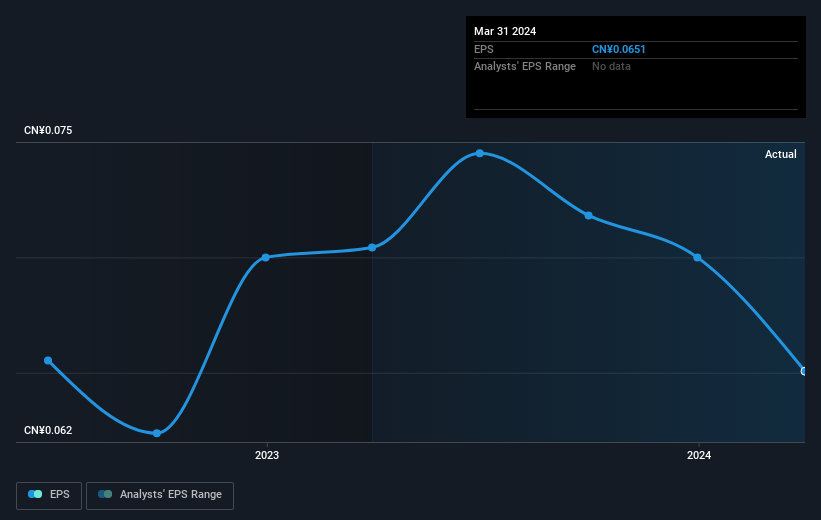

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Looking back five years, both Jiangsu Broadcasting Cable Information Network's share price and EPS declined; the latter at a rate of 14% per year. This fall in the EPS is worse than the 9% compound annual share price fall. The relatively muted share price reaction might be because the market expects the business to turn around.

Looking back five years, both Jiangsu Broadcasting Cable Information Network's share price and EPS declined; the latter at a rate of 14% per year. This fall in the EPS is worse than the 9% compound annual share price fall. The relatively muted share price reaction might be because the market expects the business to turn around.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We regret to report that Jiangsu Broadcasting Cable Information Network shareholders are down 23% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 20%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Jiangsu Broadcasting Cable Information Network (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course Jiangsu Broadcasting Cable Information Network may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com