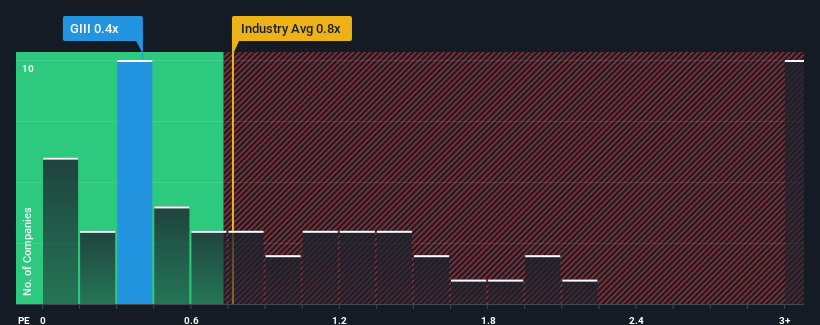

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Luxury industry in the United States, you could be forgiven for feeling indifferent about G-III Apparel Group, Ltd.'s (NASDAQ:GIII) P/S ratio of 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does G-III Apparel Group's Recent Performance Look Like?

While the industry has experienced revenue growth lately, G-III Apparel Group's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on G-III Apparel Group.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, G-III Apparel Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 1.4% decrease to the company's top line. Still, the latest three year period has seen an excellent 43% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Retrospectively, the last year delivered a frustrating 1.4% decrease to the company's top line. Still, the latest three year period has seen an excellent 43% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 3.7% over the next year. With the industry predicted to deliver 3.6% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that G-III Apparel Group's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A G-III Apparel Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Luxury industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Before you take the next step, you should know about the 1 warning sign for G-III Apparel Group that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com