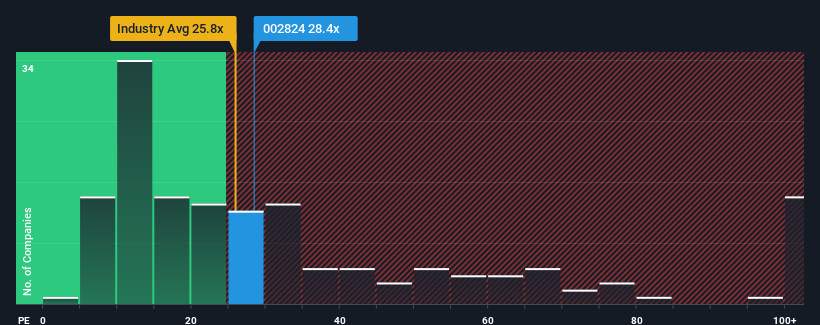

There wouldn't be many who think Guangdong Hoshion Industrial Aluminium Co., Ltd.'s (SZSE:002824) price-to-earnings (or "P/E") ratio of 28.4x is worth a mention when the median P/E in China is similar at about 28x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Guangdong Hoshion Industrial Aluminium could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Does Growth Match The P/E?

In order to justify its P/E ratio, Guangdong Hoshion Industrial Aluminium would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 28% each year over the next three years. With the market only predicted to deliver 24% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Guangdong Hoshion Industrial Aluminium's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Guangdong Hoshion Industrial Aluminium currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for Guangdong Hoshion Industrial Aluminium (1 doesn't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on Guangdong Hoshion Industrial Aluminium, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com