For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Suzhou Kingswood Education Technology (SZSE:300192). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Suzhou Kingswood Education Technology's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Suzhou Kingswood Education Technology's EPS skyrocketed from CN¥0.29 to CN¥0.44, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 50%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. This approach makes Suzhou Kingswood Education Technology look pretty good, on balance; although revenue is flattish, EBIT margins improved from 16% to 21% in the last year. That's something to smile about.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. This approach makes Suzhou Kingswood Education Technology look pretty good, on balance; although revenue is flattish, EBIT margins improved from 16% to 21% in the last year. That's something to smile about.

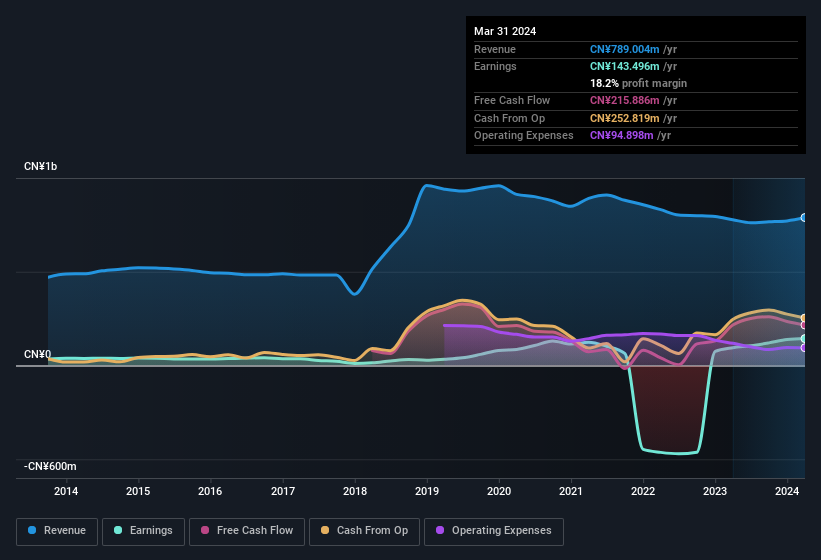

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Suzhou Kingswood Education Technology's balance sheet strength, before getting too excited.

Are Suzhou Kingswood Education Technology Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Suzhou Kingswood Education Technology will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Actually, with 39% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. at the current share price. That means they have plenty of their own capital riding on the performance of the business!

Is Suzhou Kingswood Education Technology Worth Keeping An Eye On?

For growth investors, Suzhou Kingswood Education Technology's raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Even so, be aware that Suzhou Kingswood Education Technology is showing 2 warning signs in our investment analysis , you should know about...

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com