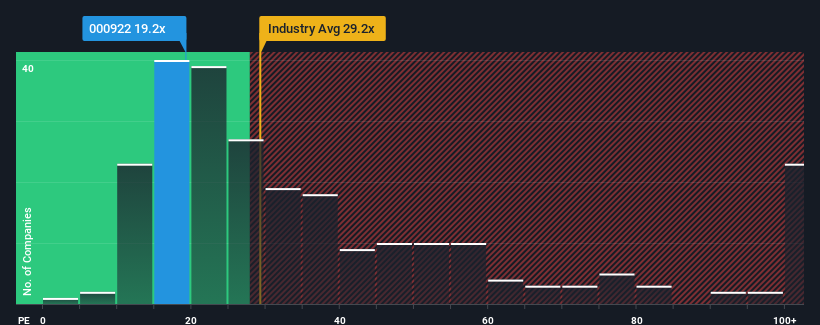

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 29x, you may consider Harbin Electric Corporation Jiamusi Electric Machine CO.,Ltd (SZSE:000922) as an attractive investment with its 19.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Harbin Electric Corporation Jiamusi Electric MachineLtd hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Harbin Electric Corporation Jiamusi Electric MachineLtd's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 7.3% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 7.3% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 20% per annum during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 24% each year growth forecast for the broader market.

In light of this, it's understandable that Harbin Electric Corporation Jiamusi Electric MachineLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Harbin Electric Corporation Jiamusi Electric MachineLtd's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Harbin Electric Corporation Jiamusi Electric MachineLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Harbin Electric Corporation Jiamusi Electric MachineLtd that you should be aware of.

You might be able to find a better investment than Harbin Electric Corporation Jiamusi Electric MachineLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com