Deep-pocketed investors have adopted a bearish approach towards Amgen (NASDAQ:AMGN), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMGN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Amgen. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 60% bearish. Among these notable options, 6 are puts, totaling $259,893, and 4 are calls, amounting to $155,093.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $295.0 to $360.0 for Amgen during the past quarter.

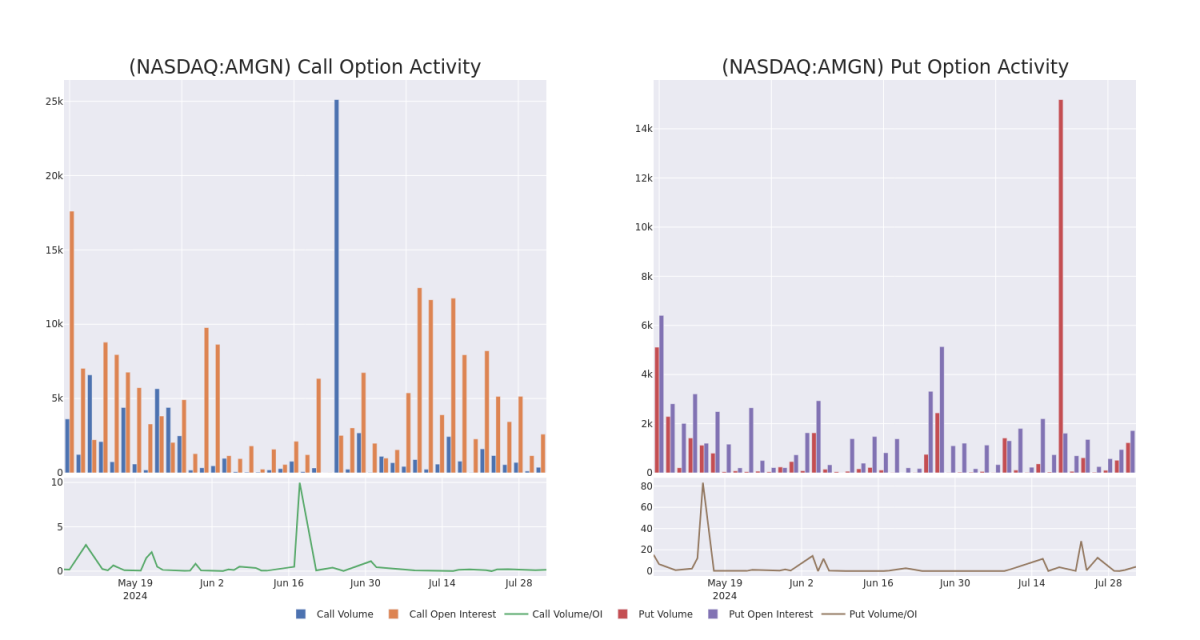

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Amgen options trades today is 539.75 with a total volume of 1,599.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Amgen's big money trades within a strike price range of $295.0 to $360.0 over the last 30 days.

Amgen Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | PUT | SWEEP | BEARISH | 08/09/24 | $8.35 | $7.85 | $8.35 | $327.50 | $70.9K | 62 | 90 |

| AMGN | PUT | SWEEP | BEARISH | 10/18/24 | $8.8 | $8.2 | $8.8 | $315.00 | $62.4K | 495 | 77 |

| AMGN | CALL | TRADE | BULLISH | 01/17/25 | $50.15 | $49.25 | $50.15 | $300.00 | $50.1K | 1.5K | 0 |

| AMGN | CALL | TRADE | BULLISH | 10/18/24 | $7.65 | $7.55 | $7.65 | $360.00 | $48.1K | 397 | 343 |

| AMGN | PUT | TRADE | BULLISH | 01/17/25 | $19.35 | $18.55 | $18.55 | $310.00 | $33.3K | 1.0K | 20 |

About Amgen

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

Following our analysis of the options activities associated with Amgen, we pivot to a closer look at the company's own performance.

Current Position of Amgen

- With a volume of 1,143,672, the price of AMGN is down -0.98% at $332.25.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 4 days.

What Analysts Are Saying About Amgen

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $303.0.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Amgen, which currently sits at a price target of $303.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Amgen options trades with real-time alerts from Benzinga Pro.