Shenzhen Urban Transport Planning Center Co., Ltd. (SZSE:301091) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. The last month tops off a massive increase of 139% in the last year.

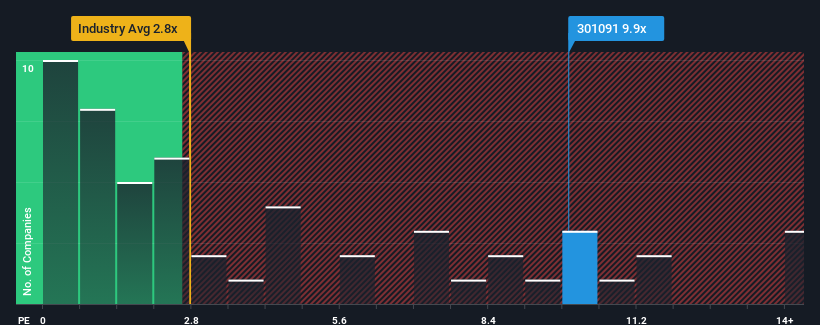

Following the firm bounce in price, when almost half of the companies in China's Professional Services industry have price-to-sales ratios (or "P/S") below 2.8x, you may consider Shenzhen Urban Transport Planning Center as a stock not worth researching with its 9.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Shenzhen Urban Transport Planning Center's P/S Mean For Shareholders?

Recent times haven't been great for Shenzhen Urban Transport Planning Center as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Urban Transport Planning Center will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Shenzhen Urban Transport Planning Center's is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as Shenzhen Urban Transport Planning Center's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. The solid recent performance means it was also able to grow revenue by 30% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 32% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 41%, which is noticeably more attractive.

In light of this, it's alarming that Shenzhen Urban Transport Planning Center's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

The strong share price surge has lead to Shenzhen Urban Transport Planning Center's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Shenzhen Urban Transport Planning Center currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Shenzhen Urban Transport Planning Center (of which 1 can't be ignored!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com