Jiangsu Zhengdan Chemical Industry Co., Ltd. (SZSE:300641) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Nonetheless, the last 30 days have barely left a scratch on the stock's annual performance, which is up a whopping 343%.

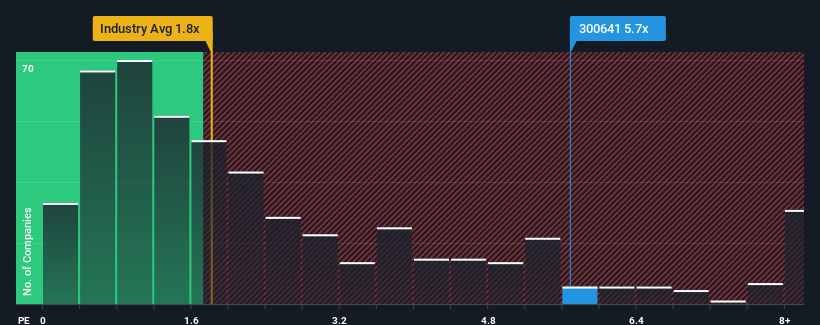

In spite of the heavy fall in price, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 1.8x, you may still consider Jiangsu Zhengdan Chemical Industry as a stock to avoid entirely with its 5.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has Jiangsu Zhengdan Chemical Industry Performed Recently?

Jiangsu Zhengdan Chemical Industry certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangsu Zhengdan Chemical Industry's earnings, revenue and cash flow.How Is Jiangsu Zhengdan Chemical Industry's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangsu Zhengdan Chemical Industry's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangsu Zhengdan Chemical Industry's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. Pleasingly, revenue has also lifted 39% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 23% shows it's noticeably less attractive.

In light of this, it's alarming that Jiangsu Zhengdan Chemical Industry's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

A significant share price dive has done very little to deflate Jiangsu Zhengdan Chemical Industry's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Jiangsu Zhengdan Chemical Industry currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Jiangsu Zhengdan Chemical Industry (of which 2 can't be ignored!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com