If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Weaver Network Technology Co., Ltd. (SHSE:603039) have had an unfortunate run in the last three years. Sadly for them, the share price is down 63% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 61% lower in that time. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days. But this could be related to the weak market, which is down 12% in the same period.

After losing 5.2% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

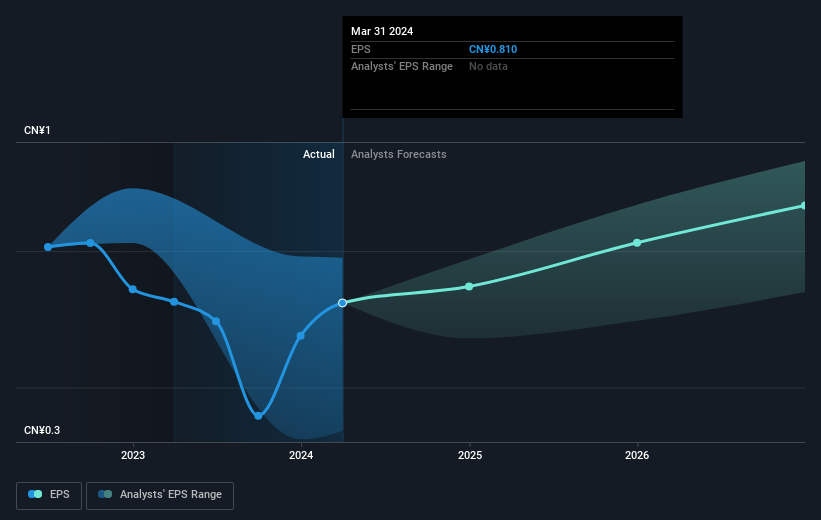

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, Weaver Network Technology's earnings per share (EPS) dropped by 4.9% each year. This reduction in EPS is slower than the 28% annual reduction in the share price. So it seems the market was too confident about the business, in the past.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While the broader market lost about 19% in the twelve months, Weaver Network Technology shareholders did even worse, losing 60% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Is Weaver Network Technology cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.