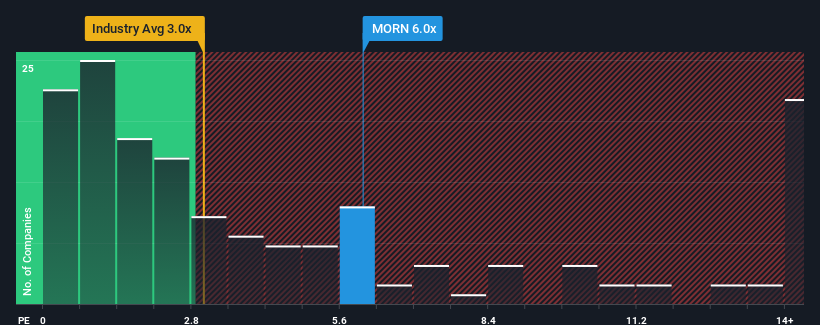

When close to half the companies in the Capital Markets industry in the United States have price-to-sales ratios (or "P/S") below 3x, you may consider Morningstar, Inc. (NASDAQ:MORN) as a stock to avoid entirely with its 6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has Morningstar Performed Recently?

Recent times haven't been great for Morningstar as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Morningstar will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Morningstar's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. This was backed up an excellent period prior to see revenue up by 40% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. This was backed up an excellent period prior to see revenue up by 40% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 9.1% per year during the coming three years according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.3% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Morningstar's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Morningstar's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Morningstar shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 1 warning sign for Morningstar you should be aware of.

If you're unsure about the strength of Morningstar's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.