August 13, 2024 - $Sea (SE.US)$ shares surged 8.23% to $72.429 on Tuesday. The company today announced its financial results for the second quarter ended June 30, 2024.

Q2 Highlights by Segments

Group

Total GAAP revenue was US$3.8 billion, up 23.0% year-on-year.

Total gross profit was US$1.6 billion, up 9.2% year-on-year.

Total net income was US$79.9 million, as compared to total net income of US$331.0 million for the second quarter of 2023.

Total adjusted EBITDA1 was US$448.5 million, as compared to US$510.0 million for the second quarter of 2023.

As of June 30, 2024, cash, cash equivalents, short-term investments, and other treasury investments2 were US$9.0 billion, representing a net increase of US$364.7 million from March 31, 2024.

E-commerce

Gross orders totaled 2.5 billion for the quarter, increasing by 40.3% year-on-year.

GMV was US$23.3 billion for the quarter, increasing by 29.1% year-on-year.

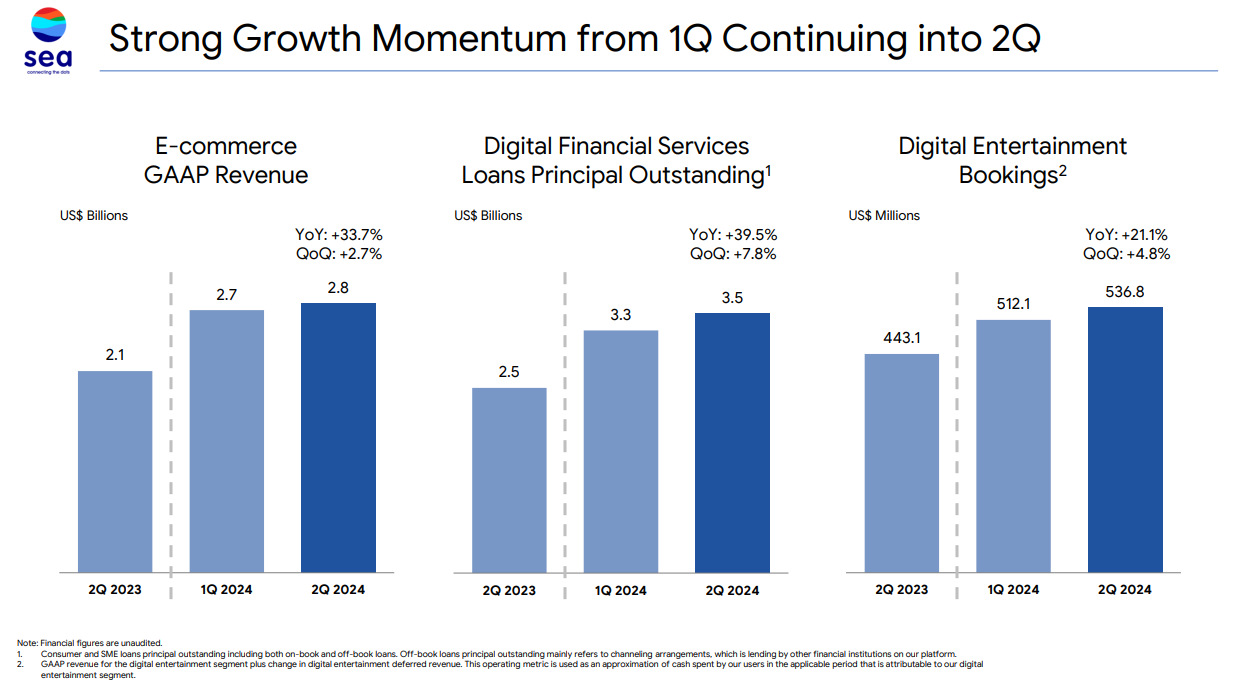

GAAP revenue was US$2.8 billion, up 33.7% year-on-year.

GAAP revenue included US$2.5 billion of GAAP marketplace revenue, which consists of core marketplace revenue and value-added services revenue and increased by 32.7% year-on-year.

Adjusted EBITDA1 was US$(9.2) million, as compared to US$150.3 million for the second quarter of 2023.

Digital Financial Services

GAAP revenue was US$519.3 million, up 21.4% year-on-year.

Adjusted EBITDA1 was US$164.7 million, up 20.2% year-on-year.

Digital financial services revenue and operating income are primarily attributed to the consumer and SME credit business. As of June 30, 2024, consumer and SME loans principal outstanding was US$3.5 billion, up 39.5% year-on-year. This consists of US$2.9 billion on-book and US$0.7 billion off-book loans principal outstanding.

Non-performing loans past due by more than 90 days as a percentage of consumer and SME loans principal outstanding, which includes both on-book and off-book loans principal outstanding4 , was 1.3%, a slight improvement quarter-on-quarter.

Digital Entertainment

Bookings5 were US$536.8 million, up 21.1% year-on-year.

GAAP revenue was US$435.6 million, as compared to US$529.4 million for the second quarter of 2023.

Adjusted EBITDA1 was US$302.8 million, up 26.5% year-on-year.

Adjusted EBITDA represented 56.4% of bookings for the second quarter of 2024, as compared to 54.0% for the second quarter of 2023.

Quarterly active users were 648.0 million, up 19.0% year-on-year. o Quarterly paying users were 52.5 million, up 21.7% year-on-year. Paying user ratio was 8.1%, as compared to 7.9% for the second quarter of 2023.

Average bookings per user were US$0.83, as compared to US$0.81 for the second quarter of 2023.

“I’m happy to report that it has been a solid quarter for us, with our strong momentum from Q1 continuing into Q2. All three of our businesses have shown both strong growth and higher profitability,” said Forrest Li, Sea’s Chairman and Chief Executive Officer.

On Shopee’s 2024 outlook, he said “With the strong results delivered in the first half and our outlook for the rest of the year, we expect that Shopee will become adjusted EBITDA positive from the third quarter. We are also revising up our guidance for Shopee’s 2024 full year GMV growth to mid-20%.”

Related Reading: Press Release