Benzinga's options scanner has just identified more than 12 option transactions on American Tower (NYSE:AMT), with a cumulative value of $799,652. Concurrently, our algorithms picked up 9 puts, worth a total of 705,932.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $200.0 and $220.0 for American Tower, spanning the last three months.

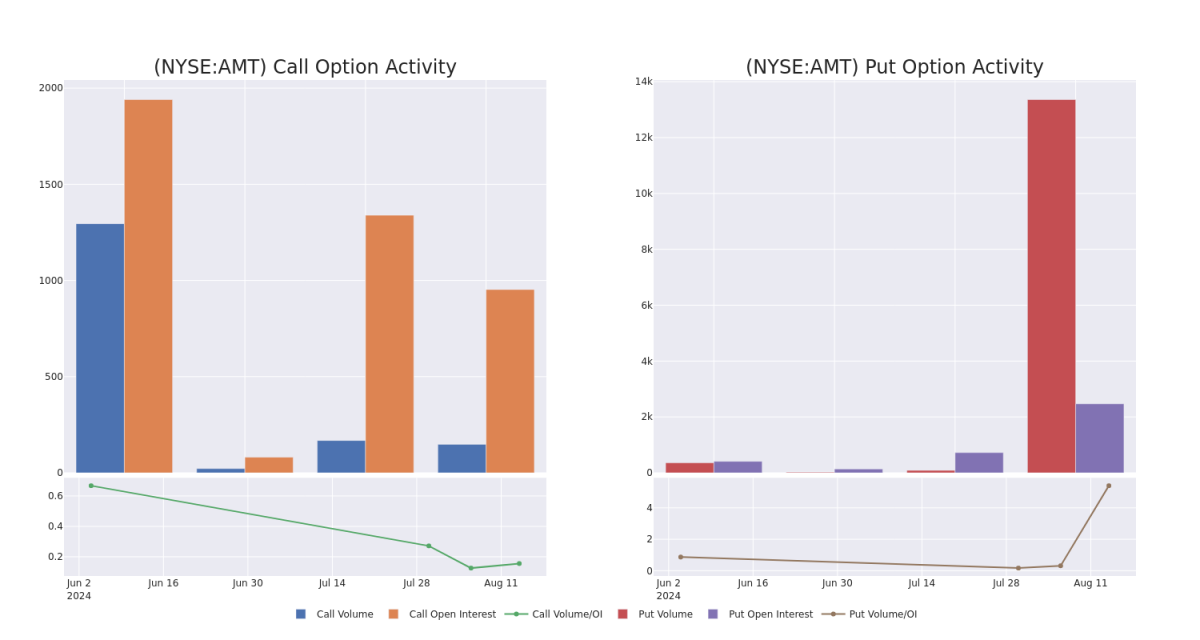

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for American Tower options trades today is 855.5 with a total volume of 13,506.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for American Tower's big money trades within a strike price range of $200.0 to $220.0 over the last 30 days.

American Tower Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMT | PUT | SWEEP | BULLISH | 09/20/24 | $4.6 | $4.0 | $4.1 | $220.00 | $289.7K | 2.4K | 1.0K |

| AMT | PUT | SWEEP | BULLISH | 09/20/24 | $4.8 | $4.2 | $4.2 | $220.00 | $135.3K | 2.4K | 320 |

| AMT | CALL | TRADE | BULLISH | 08/16/24 | $14.2 | $13.7 | $14.2 | $210.00 | $93.7K | 579 | 88 |

| AMT | PUT | TRADE | BULLISH | 09/20/24 | $4.5 | $4.2 | $4.2 | $220.00 | $44.5K | 2.4K | 2.0K |

| AMT | PUT | TRADE | BULLISH | 09/20/24 | $4.3 | $4.0 | $4.0 | $220.00 | $42.4K | 2.4K | 1.9K |

About American Tower

American Tower owns and operates more than 220,000 cell towers throughout the us, Asia, Latin America, Europe, and Africa. It also owns and/or operates 28 data centers in 10 us markets after acquiring CoreSite. On its towers, the company has a very concentrated customer base, with most revenue in each market being generated by just the top few mobile carriers. The company operates more than 40,000 towers in the us, which accounted for almost half of the company's total revenue in 2023. Outside the us, American Tower operates over 75,000 towers in India, almost 50,000 towers in Latin America (dominated by Brazil), 30,000 towers in Europe, and nearly 25,000 towers in Africa. American Tower operates as a REIT.

In light of the recent options history for American Tower, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of American Tower

- Currently trading with a volume of 2,289,241, the AMT's price is up by 0.23%, now at $223.18.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 71 days.

What The Experts Say On American Tower

5 market experts have recently issued ratings for this stock, with a consensus target price of $243.6.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on American Tower with a target price of $246.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for American Tower, targeting a price of $245.

- An analyst from JP Morgan has decided to maintain their Overweight rating on American Tower, which currently sits at a price target of $240.

- An analyst from TD Cowen persists with their Buy rating on American Tower, maintaining a target price of $239.

- Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Outperform rating for American Tower, targeting a price of $248.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest American Tower options trades with real-time alerts from Benzinga Pro.