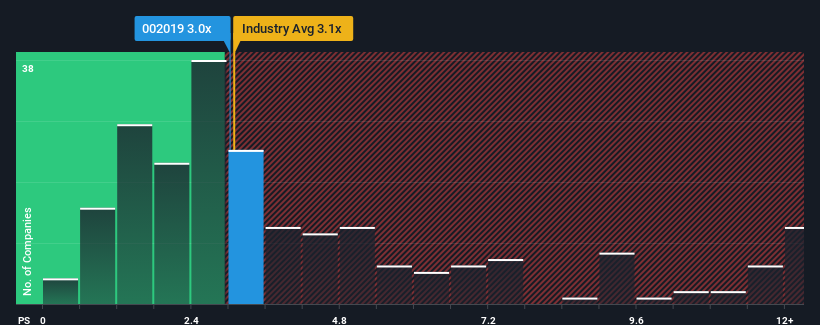

There wouldn't be many who think Yifan Pharmaceutical Co., Ltd.'s (SZSE:002019) price-to-sales (or "P/S") ratio of 3x is worth a mention when the median P/S for the Pharmaceuticals industry in China is similar at about 3.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Yifan Pharmaceutical Has Been Performing

Yifan Pharmaceutical could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Yifan Pharmaceutical will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Yifan Pharmaceutical's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 4.2% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 4.2% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 24% over the next year. That's shaping up to be materially higher than the 17% growth forecast for the broader industry.

With this information, we find it interesting that Yifan Pharmaceutical is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Yifan Pharmaceutical currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Yifan Pharmaceutical that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.