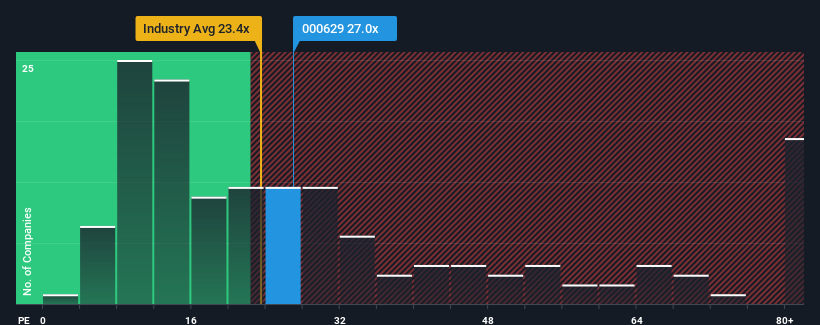

With a median price-to-earnings (or "P/E") ratio of close to 27x in China, you could be forgiven for feeling indifferent about Pangang Group Vanadium & Titanium Resources Co., Ltd.'s (SZSE:000629) P/E ratio of 27x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Pangang Group Vanadium & Titanium Resources' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

How Is Pangang Group Vanadium & Titanium Resources' Growth Trending?

Pangang Group Vanadium & Titanium Resources' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 54% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 54% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 24% per year, which is noticeably more attractive.

In light of this, it's curious that Pangang Group Vanadium & Titanium Resources' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Pangang Group Vanadium & Titanium Resources' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Pangang Group Vanadium & Titanium Resources with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Pangang Group Vanadium & Titanium Resources. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.