It's nice to see the AMC Networks Inc. (NASDAQ:AMCX) share price up 13% in a week. But that is meagre solace in the face of the shocking decline over three years. The share price has sunk like a leaky ship, down 79% in that time. So we're relieved for long term holders to see a bit of uplift. Of course the real question is whether the business can sustain a turnaround.

On a more encouraging note the company has added US$52m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

AMC Networks became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

AMC Networks became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

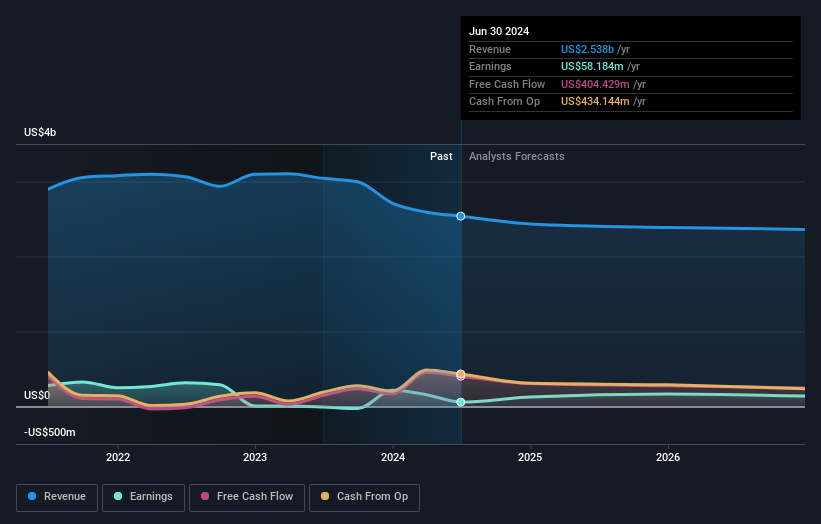

Arguably the revenue decline of 4.6% per year has people thinking AMC Networks is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that AMC Networks has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for AMC Networks in this interactive graph of future profit estimates.

A Different Perspective

AMC Networks shareholders are down 11% for the year, but the market itself is up 28%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 12% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for AMC Networks (1 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.