$YTLPOWR (6742.MY)$ and $YTL (4677.MY)$ still fell slightly. After the Black Tuesday just passed, YTLpower fell 8.1% to 3.86 in a single day. The stock price returned to the April level. YTL fell 9.51% to 3.14, hitting the biggest drop this year.

What happened?

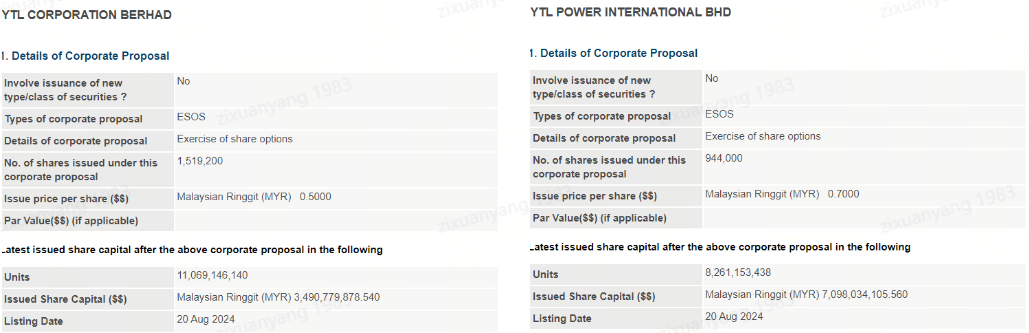

YTL issued an announcement on 19 Aug announcing the issuance of employee stock options (ESOS) at RM0.5, and YTLpower issued an announcement on 16 Aug announcing the issuance of employee stock options (ESOS) at RM0.7 to incentivize executives or employees with good performance.

This will increase the company's total issued shares. Employees holding shares through ESOS have a lower cost basis, which may have an impact on the share price if they sell a large number of shares.

This will increase the company's total issued shares. Employees holding shares through ESOS have a lower cost basis, which may have an impact on the share price if they sell a large number of shares.

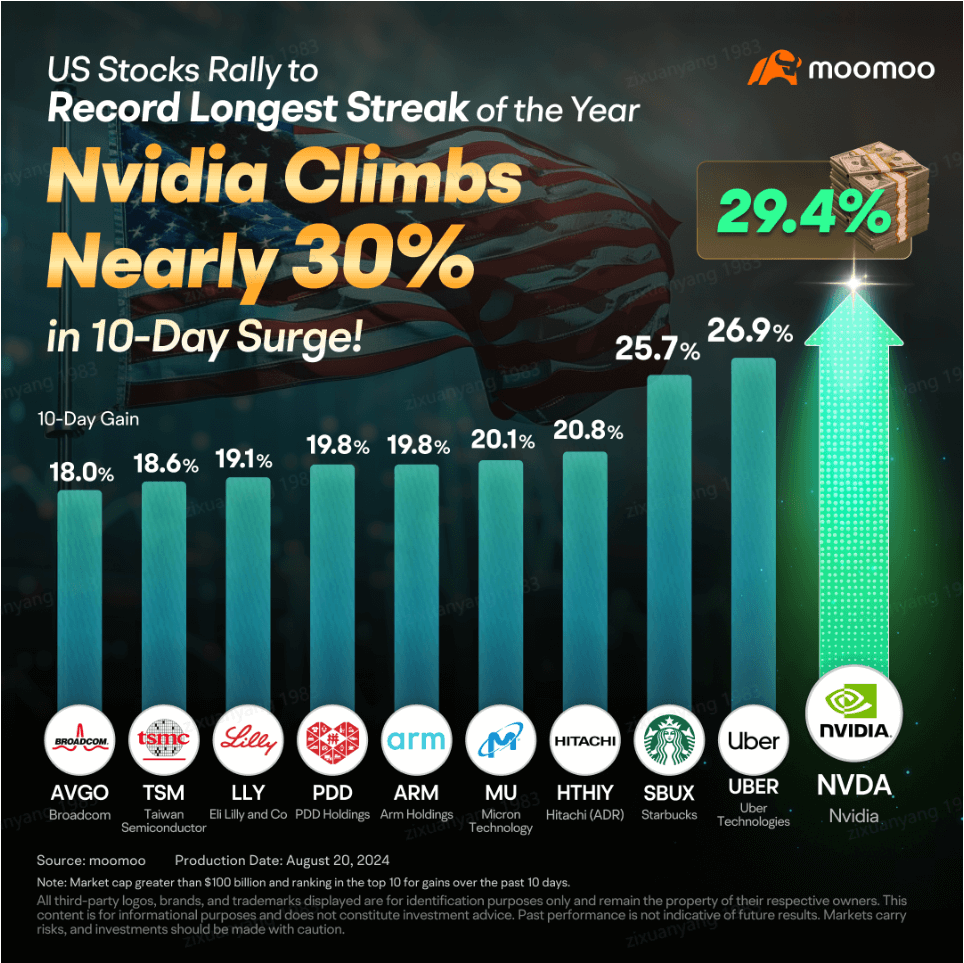

$YTL (4677.MY)$ and $NVIDIA (NVDA.US)$ started cooperation negotiations with Nvidia at the end of last year, and since then the stock price has risen by more than 109% from around 1.9 RM to a high of 3.92 RM in May.

YTLPOWER announced in March this year that it would establish YTL AI Cloud and develop and operate one of the world's most advanced AI supercomputers in Johor. The cooperation with Nvidia has become one of the important catalysts for its stock price to strengthen.

Financial report is about to be released

Nvidia will also release Q2 performance data after the market on August 28. Despite potential supply chain challenges, analysts predict that Nvidia's revenue is expected to grow strongly driven by demand for artificial intelligence, games and data centers. In addition, Goldman Sachs maintains a strong buy rating on Nvidia and maintains a stable stock target price.

Of course, if you are interested in higher volatility and continue to pay attention to semiconductor technology stocks, you can also consider these tickers:

$GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$

$Direxion Daily Semiconductor Bear 3x Shares ETF (SOXS.US)$

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

According to Bloomberg, $YTL (4677.MY)$ and $YTLPOWR (6742.MY)$ are expected to release financial reports on 23Aug. YTLPower completed a comprehensive tender offer for Ranhill Utilities in July, further consolidating its position in the industry. The growth of data centers will promote the growth of electricity demand. One year after the launch of Malaysia's National Energy Transformation Roadmap (NETR), the market remains optimistic about the utility industry.