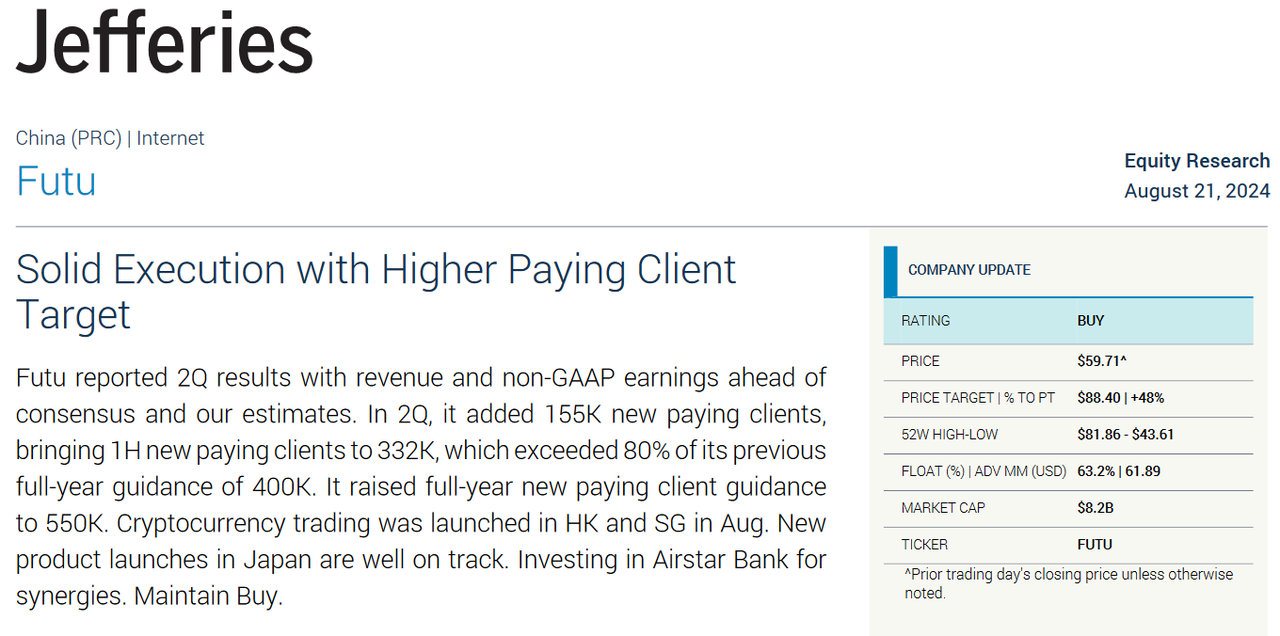

On August 21, 2024, Jefferies released a research report, maintaining a "BUY" rating with a price target of $88.4 for Futu Holdings. In the research report, Jefferies pointed out:

1) Futu reported 2Q results with revenue and non-GAAP earnings ahead of consensus and Jefferies' estimates, primarily driven by high growth in commission and fee income as well as interest income.

2) In 2Q, 155K new paying clients were added, totaling 332K for 1H, exceeding 80% of the previous full-year target of 400K. The full-year guidance is now raised to 550K new paying clients.

3) Cryptocurrency trading was launched in HK and SG in Aug., new product launches in Japan are progressing well, and the company is investing in Airstar Bank for synergies.

3) Cryptocurrency trading was launched in HK and SG in Aug., new product launches in Japan are progressing well, and the company is investing in Airstar Bank for synergies.

4) The number of new paying clients in Japan and Malaysia grew rapidly.

5) Jefferies believes strong demand from global high net-worth individuals for geographically diverse investment portfolios will drive Futu's financial and wealth management growth. Futu leads peers in technology, operating efficiency, and financial licenses.

Catalysts

Improvement of commission fee rates and interest rates;

Stronger-than-expected investor demand;

Stronger-than-expected user growth and traffic conversion.

Risks to Downside

Compliance risk and regulatory risk;

Macro-headwinds impacting securities market trading volume in the US, HK and SG;

Loss of market share due to competition;

Lower-than-expected commission fee rate and interest rate.

2024年8月21日、ジェフリーズはレポートを発表、Futu Holdingsの目標株価を88.4ドル、「買い」レーティングを維持した。ジェフリーズは次のように指摘している:

1) Futuは第2四半期の決算を発表、売上高や非GAAPベース純利益はコンセンサスおよびジェフリーズの予想を上回った。

2) 第2四半期に15.5万人、上半期は合計33.2万人の新規有料顧客を獲得し、従来40万人の通期ガイダンスの8割以上を達成。Futuは新規有料顧客数の通期ガイダンスを55万人に引き上げた。

3) 8月、香港とシンガポールで暗号通貨取引機能を新たに導入。日本における新しいプロダクトの展開は順調。同社はまた相乗効果を狙って、Airstar Bankに投資。

3) 8月、香港とシンガポールで暗号通貨取引機能を新たに導入。日本における新しいプロダクトの展開は順調。同社はまた相乗効果を狙って、Airstar Bankに投資。

4) 日本とマレーシアの新規有料顧客数は堅調に伸び。

5) ジェフリーズは、世界中の富裕層からの多様な投資ポートフォリオに対する強い需要が、Futuの金融・資産管理の成長を促進すると確信している。Futuは技術、営業効率、財務ライセンスで同業他社をリード。

促進要因

下振れリスク

3) 8月、香港とシンガポールで暗号通貨取引機能を新たに導入。日本における新しいプロダクトの展開は順調。同社はまた相乗効果を狙って、Airstar Bankに投資。

3) 8月、香港とシンガポールで暗号通貨取引機能を新たに導入。日本における新しいプロダクトの展開は順調。同社はまた相乗効果を狙って、Airstar Bankに投資。

3) Cryptocurrency trading was launched in HK and SG in Aug., new product launches in Japan are progressing well, and the company is investing in Airstar Bank for synergies.

3) Cryptocurrency trading was launched in HK and SG in Aug., new product launches in Japan are progressing well, and the company is investing in Airstar Bank for synergies.