Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies COFCO Capital Holdings Co., Ltd. (SZSE:002423) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is COFCO Capital Holdings's Debt?

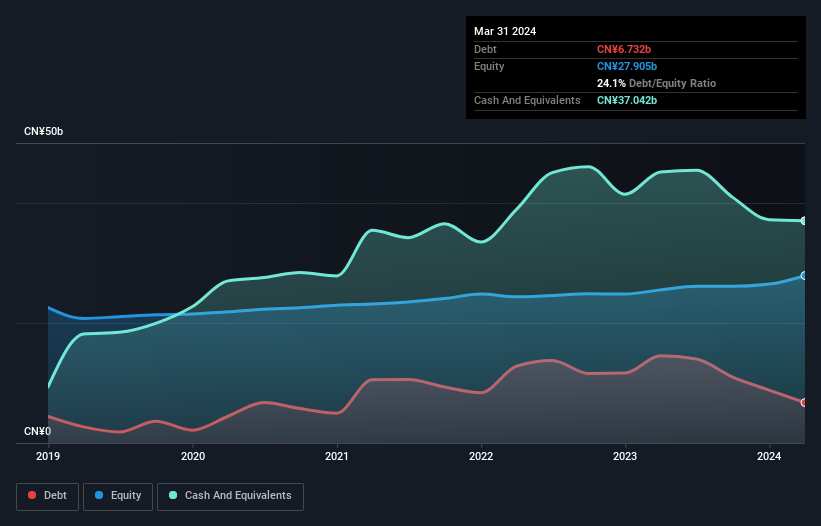

As you can see below, COFCO Capital Holdings had CN¥6.73b of debt at March 2024, down from CN¥14.5b a year prior. But on the other hand it also has CN¥37.0b in cash, leading to a CN¥30.3b net cash position.

How Strong Is COFCO Capital Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that COFCO Capital Holdings had liabilities of CN¥38.2b due within 12 months and liabilities of CN¥66.3b due beyond that. On the other hand, it had cash of CN¥37.0b and CN¥3.36b worth of receivables due within a year. So it has liabilities totalling CN¥64.1b more than its cash and near-term receivables, combined.

Zooming in on the latest balance sheet data, we can see that COFCO Capital Holdings had liabilities of CN¥38.2b due within 12 months and liabilities of CN¥66.3b due beyond that. On the other hand, it had cash of CN¥37.0b and CN¥3.36b worth of receivables due within a year. So it has liabilities totalling CN¥64.1b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the CN¥17.8b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, COFCO Capital Holdings would likely require a major re-capitalisation if it had to pay its creditors today. Given that COFCO Capital Holdings has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

Sadly, COFCO Capital Holdings's EBIT actually dropped 2.6% in the last year. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. There's no doubt that we learn most about debt from the balance sheet. But it is COFCO Capital Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While COFCO Capital Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, COFCO Capital Holdings actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

Although COFCO Capital Holdings's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of CN¥30.3b. The cherry on top was that in converted 319% of that EBIT to free cash flow, bringing in CN¥8.9b. So although we see some areas for improvement, we're not too worried about COFCO Capital Holdings's balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for COFCO Capital Holdings you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.