Investors with a lot of money to spend have taken a bearish stance on Analog Devices (NASDAQ:ADI).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ADI, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ADI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 13 uncommon options trades for Analog Devices.

This isn't normal.

The overall sentiment of these big-money traders is split between 46% bullish and 53%, bearish.

Out of all of the special options we uncovered, 10 are puts, for a total amount of $2,231,539, and 3 are calls, for a total amount of $207,552.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $240.0 for Analog Devices over the recent three months.

Analyzing Volume & Open Interest

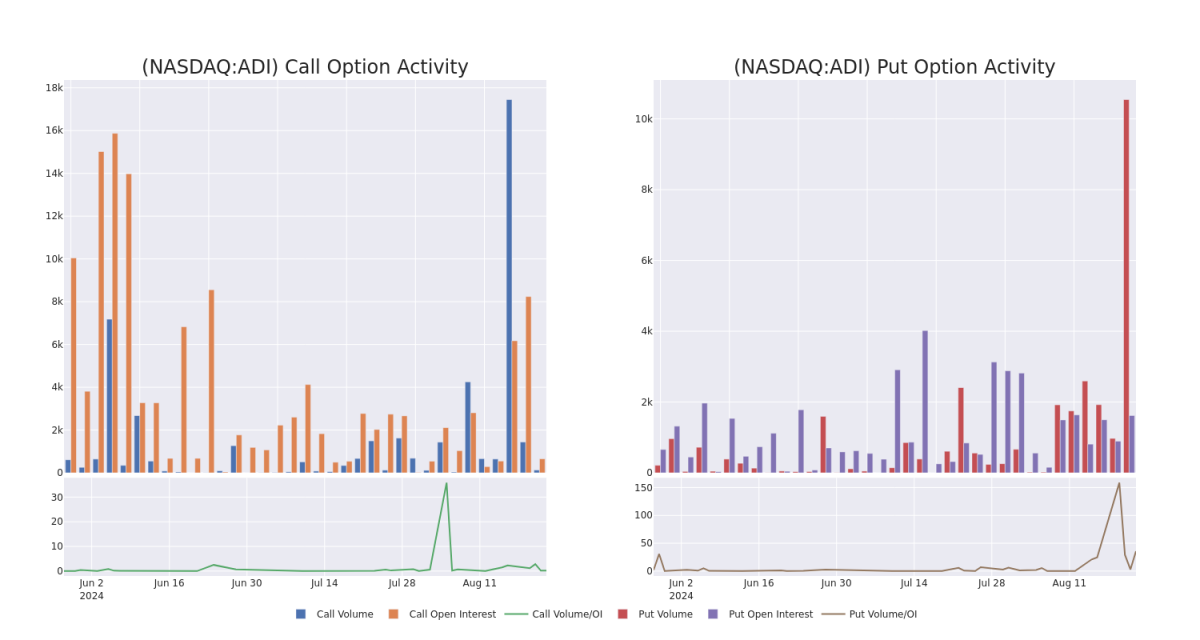

In today's trading context, the average open interest for options of Analog Devices stands at 325.0, with a total volume reaching 10,673.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Analog Devices, situated within the strike price corridor from $200.0 to $240.0, throughout the last 30 days.

Analog Devices Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADI | PUT | SWEEP | BEARISH | 09/20/24 | $8.1 | $7.7 | $8.1 | $230.00 | $627.7K | 652775 | |

| ADI | PUT | SWEEP | BULLISH | 09/20/24 | $8.2 | $8.1 | $8.2 | $230.00 | $369.8K | 6521.7K | |

| ADI | PUT | TRADE | BEARISH | 08/23/24 | $3.7 | $2.7 | $3.3 | $230.00 | $329.0K | 1281.0K | |

| ADI | PUT | TRADE | BULLISH | 08/23/24 | $3.7 | $3.0 | $3.0 | $230.00 | $300.0K | 1282.0K | |

| ADI | PUT | SWEEP | BULLISH | 09/20/24 | $8.4 | $8.2 | $8.3 | $230.00 | $201.7K | 6521.2K |

About Analog Devices

Analog Devices is a leading analog, mixed signal, and digital signal processing chipmaker. The firm has a significant market share lead in converter chips, which are used to translate analog signals to digital and vice versa. The company serves tens of thousands of customers, and more than half of its chip sales are made to industrial and automotive end markets. Analog Devices' chips are also incorporated into wireless infrastructure equipment.

Present Market Standing of Analog Devices

- With a volume of 1,185,735, the price of ADI is up 2.41% at $227.26.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 88 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Analog Devices with Benzinga Pro for real-time alerts.