Northwest Pipe Company (NASDAQ:NWPX) shareholders have had their patience rewarded with a 25% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

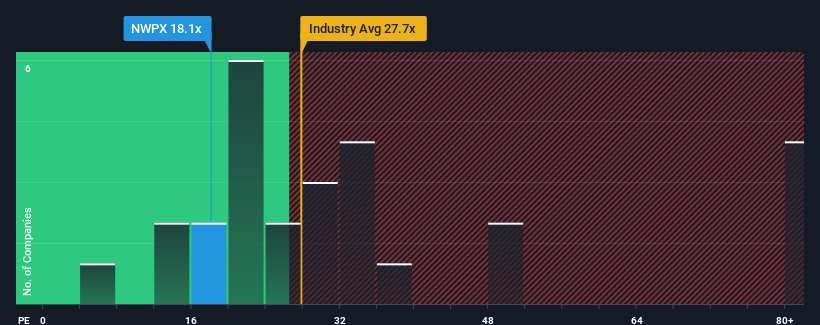

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Northwest Pipe's P/E ratio of 18.1x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Northwest Pipe as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Is There Some Growth For Northwest Pipe?

Northwest Pipe's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Northwest Pipe's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 9.5%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 48% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 4.5% per year over the next three years. With the market predicted to deliver 10% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Northwest Pipe's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Northwest Pipe's P/E?

Northwest Pipe's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Northwest Pipe's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Northwest Pipe with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.