It's not possible to invest over long periods without making some bad investments. But really bad investments should be rare. So consider, for a moment, the misfortune of Yonyou Network Technology Co.,Ltd. (SHSE:600588) investors who have held the stock for three years as it declined a whopping 76%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The more recent news is of little comfort, with the share price down 50% in a year. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days. Of course, this share price action may well have been influenced by the 13% decline in the broader market, throughout the period.

After losing 3.5% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Yonyou Network TechnologyLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Yonyou Network TechnologyLtd saw its revenue grow by 4.5% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. But the share price crash at 21% per year does seem a bit harsh! We generally don't try to 'catch the falling knife'. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

In the last three years, Yonyou Network TechnologyLtd saw its revenue grow by 4.5% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. But the share price crash at 21% per year does seem a bit harsh! We generally don't try to 'catch the falling knife'. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

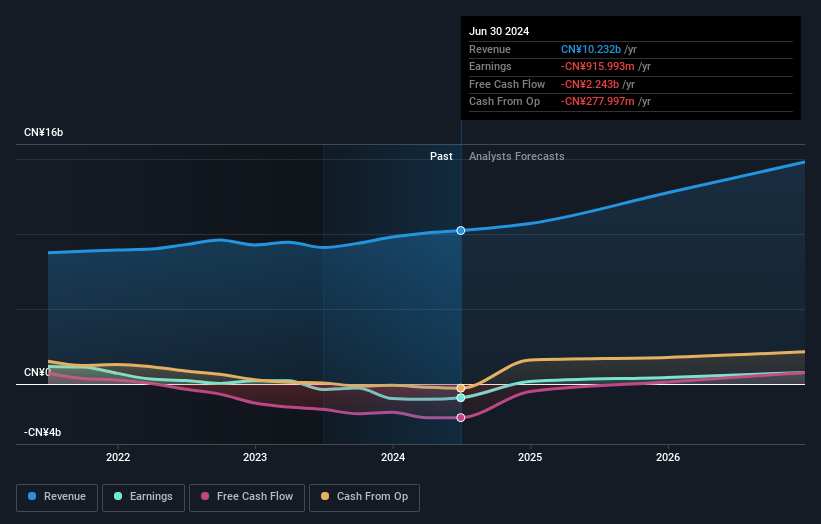

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Yonyou Network TechnologyLtd is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

While the broader market lost about 16% in the twelve months, Yonyou Network TechnologyLtd shareholders did even worse, losing 50%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Yonyou Network TechnologyLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.