The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term SolarWinds Corporation (NYSE:SWI) shareholders for doubting their decision to hold, with the stock down 63% over a half decade.

Since SolarWinds has shed US$71m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, SolarWinds moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

The revenue fall of 2.5% per year for five years is neither good nor terrible. But if the market expected durable top line growth, then that could explain the share price weakness.

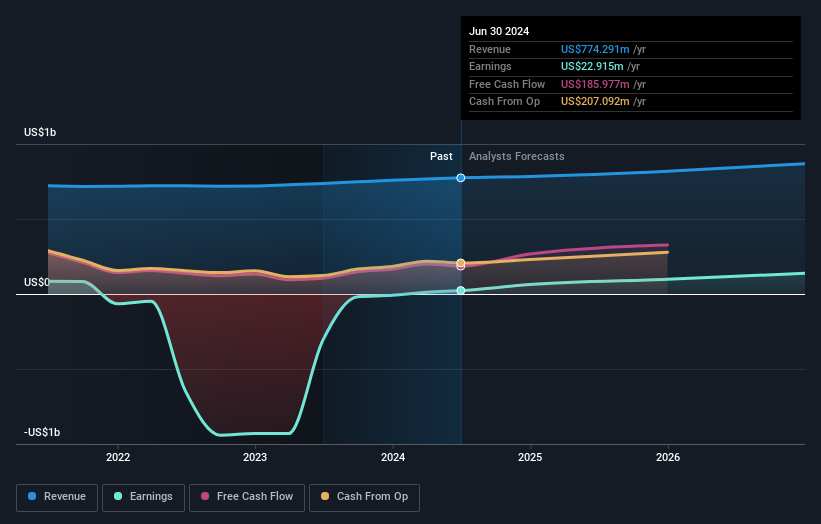

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that SolarWinds has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think SolarWinds will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between SolarWinds' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. SolarWinds hasn't been paying dividends, but its TSR of -18% exceeds its share price return of -63%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

SolarWinds' TSR for the year was broadly in line with the market average, at 28%. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 3% over the last five years. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. It's always interesting to track share price performance over the longer term. But to understand SolarWinds better, we need to consider many other factors. For example, we've discovered 3 warning signs for SolarWinds (1 is a bit concerning!) that you should be aware of before investing here.

Of course SolarWinds may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.