China Tourism And Culture Investment Group Co.,Ltd (SHSE:600358) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 38% over that time.

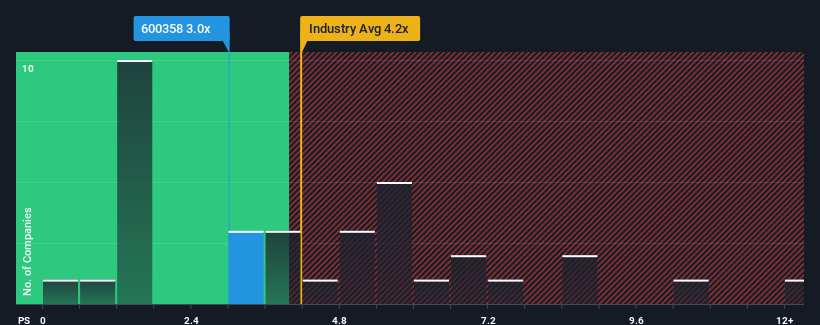

Although its price has surged higher, when close to half the companies operating in China's Hospitality industry have price-to-sales ratios (or "P/S") above 4.2x, you may still consider China Tourism And Culture Investment GroupLtd as an enticing stock to check out with its 3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does China Tourism And Culture Investment GroupLtd's Recent Performance Look Like?

For example, consider that China Tourism And Culture Investment GroupLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for China Tourism And Culture Investment GroupLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For China Tourism And Culture Investment GroupLtd?

There's an inherent assumption that a company should underperform the industry for P/S ratios like China Tourism And Culture Investment GroupLtd's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like China Tourism And Culture Investment GroupLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.8%. The last three years don't look nice either as the company has shrunk revenue by 24% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 27% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we are not surprised that China Tourism And Culture Investment GroupLtd is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does China Tourism And Culture Investment GroupLtd's P/S Mean For Investors?

The latest share price surge wasn't enough to lift China Tourism And Culture Investment GroupLtd's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of China Tourism And Culture Investment GroupLtd confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You always need to take note of risks, for example - China Tourism And Culture Investment GroupLtd has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.