Canadian retirees love to receive income from TSX dividend stocks. Why is that? Eligible Canadian dividend income is taxed at lower rates. Let's say you're getting a yield of 5% from interest income and also yielding 5% from a TSX stock generating eligible Canadian dividends. You get to keep more money in your pocket for the latter. That said, investments (such as traditional guaranteed investment certificates and bonds) that provide interest income are typically lower risk than stocks.

Within the world of TSX dividend stocks, retirees can handpick ones that provide the safety and income they need. Here are two of my top picks for steady income today.

Bank of Nova Scotia stock yields 6.5%

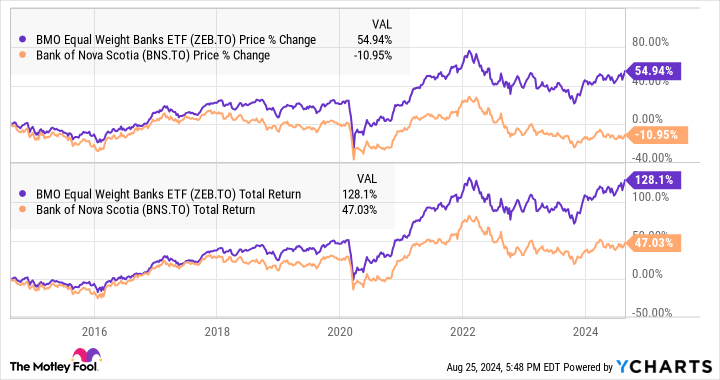

Please allow me to be crystal clear here. Bank of Nova Scotia (TSX:BNS), or Scotiabank, stock is not the lowest-risk big Canadian bank stock to own. Its risk is illustrated in its stock price action compared against its peers through the BMO Equal Weight Banks Index ETF below. Although Scotiabank stock offers a larger dividend, the stock (with or without its dividend) has underperformed over the last decade.

BNS and ZEB 10-year stock price and total return data by YCharts

BNS and ZEB 10-year stock price and total return data by YCharts

Because of its international exposure, the bank's earnings tend to be more cyclical than its peers. This has resulted in the stock being down close to 30% from its high in 2022.

There's not much to lose in the stock if retirees' key focus is steady income. BNS stock offers an attractive dividend yield of close to 6.5%, which is hard to beat. Furthermore, it has price appreciation potential if it were to turn around propelled by an improvement in the economies of the markets it serves, which is primarily Canada and Latin America. In the worst-case scenario, investors get to pocket a large dividend that's covered by earnings.

Brookfield Renewable Corporation offers a 5% dividend

Another stock for retirees to consider parking their money in for long-term dividend income is Brookfield Renewable Corp. (TSX:BEPC). It is economically equivalent to its limited partnership counterpart and pays the same cash distribution. Essentially, Brookfield Renewable has increased its dividend/cash distribution for about 14 consecutive years with a 10-year dividend growth rate of 5.7%. The corporation pays out eligible dividends yielding 5%.

It is a name to particularly like if you're supportive of cleaner energy. Brookfield Renewable's diversified portfolio includes quality assets in hydroelectric, wind, solar, distributed energy, and sustainable solutions across five continents. Going forward, retirees can expect the dividend to increase by at least 5% per year, supported by funds from operations (FFO) growth.

For example, in the first half of the year, Brookfield Renewable increased its FFO per unit by 5.5% to US$0.96, which equates to a sustainable payout ratio of about 74% in the period. The first investors in Brookfield Renewable are sitting on a yield on cost of about 20%. Imagine earning a return on your initial investment of over 20% every year – which is set to occur as the utility stock continues to increase its dividend!

With an international portfolio, Brookfield Renewable gets to participate in the multi-decade's long mega trend in renewable energy. And it can make the best global risk-adjusted investments because of its international footprint.