Whales with a lot of money to spend have taken a noticeably bullish stance on Amazon.com.

Looking at options history for Amazon.com (NASDAQ:AMZN) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $245,612 and 5, calls, for a total amount of $317,267.

From the overall spotted trades, 7 are puts, for a total amount of $245,612 and 5, calls, for a total amount of $317,267.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $180.0 for Amazon.com, spanning the last three months.

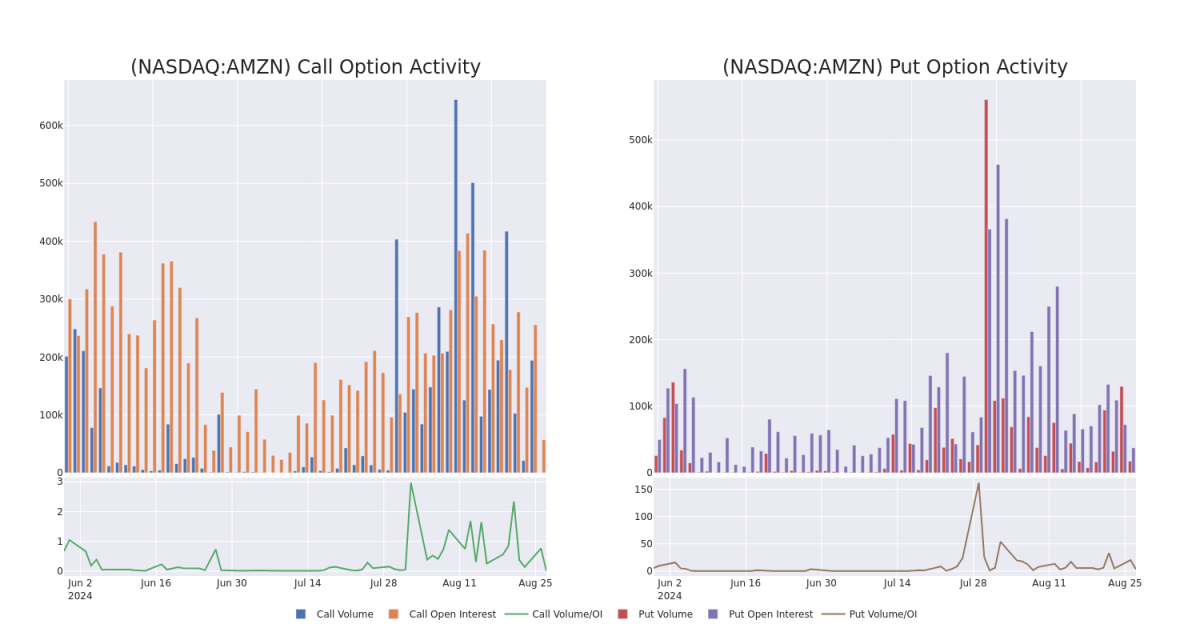

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Amazon.com options trades today is 10517.33 with a total volume of 17,597.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Amazon.com's big money trades within a strike price range of $100.0 to $180.0 over the last 30 days.

Amazon.com Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| AMZN | CALL | TRADE | NEUTRAL | 12/19/25 | $82.45 | $80.45 | $81.42 | $100.00 | $162.8K | 5.2K | 20 |

| AMZN | PUT | SWEEP | BULLISH | 08/30/24 | $3.2 | $3.15 | $3.15 | $175.00 | $63.0K | 8.8K | 2.0K |

| AMZN | CALL | SWEEP | BULLISH | 02/21/25 | $14.55 | $14.4 | $14.52 | $180.00 | $49.3K | 1.1K | 45 |

| AMZN | PUT | TRADE | BULLISH | 01/17/25 | $9.65 | $9.45 | $9.53 | $170.00 | $38.1K | 16.3K | 0 |

| AMZN | CALL | TRADE | BULLISH | 09/13/24 | $7.3 | $7.15 | $7.3 | $170.00 | $37.2K | 1.1K | 0 |

About Amazon.com

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

After a thorough review of the options trading surrounding Amazon.com, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Amazon.com Standing Right Now?

- Trading volume stands at 748,840, with AMZN's price down by -0.61%, positioned at $174.43.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 58 days.

Professional Analyst Ratings for Amazon.com

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $220.8.

- Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $225.

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Outperform with a new price target of $215.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Amazon.com, targeting a price of $224.

- An analyst from Roth MKM persists with their Buy rating on Amazon.com, maintaining a target price of $215.

- An analyst from Jefferies has decided to maintain their Buy rating on Amazon.com, which currently sits at a price target of $225.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Amazon.com options trades with real-time alerts from Benzinga Pro.

お金をたくさん持っているクジラたちは、Amazon.comに対して明らかに 強気の立場を取っています。

Amazon.com(NASDAQ:AMZN)のオプションの履歴を見ると、12件の取引を検出しました。

各取引の詳細を考慮すると、投資家のうち50%が強気の期待を持って取引を開始し、33%が弱気の期待を持って取引を開始しました。

全体の取引から、プットオプションが7つあり、合計金額は$245,612であり、コールオプションが5つあり、合計金額は$317,267です。

全体の取引から、プットオプションが7つあり、合計金額は$245,612であり、コールオプションが5つあり、合計金額は$317,267です。

予測される価格目標

取引の出来高と建玉を評価した結果、主要な市場の動向は、Amazon.comにおいて$100.0から$180.0の価格帯に焦点を当てており、過去3か月間に及んでいます。

出来高と建玉のトレンド

流動性と関心の観点から、今日のAmazon.comのオプショントレードの平均建玉は10517.33であり、総出来高は17,597.00です。

以下のチャートでは、過去30日間におけるAmazon.comの大口取引の権利行使価格範囲$100.0から$180.0のコールオプションとプットオプションの出来高と建玉の推移を追うことができます。

Amazon.comのオプション出来高と建玉過去30日間の推移

最大のオプション

| シンボル | プット/コール | 取引タイプ | センチメント | 権利行使日 | 売気配 | 買気配 | 価格 | 権利行使価格 | トータル取引価格 | 建玉 | 出来高 |

|---|

| AMZN | コール | 取引 | ニュートラル | 12/19/25 | PUT | SWEEP | BULLISH | $100.00 | CALL | 5.2K | 20 |

| AMZN | プット | スイープ | 強気 | 08/30/24 | $3.2 | $3.15 | $3.15 | 175.00ドル | $63.0K | 8.8K | 2.0K |

| AMZN | コール | スイープ | 強気 | 02/21/25 | $14.55 | $14.4 | スタイフェルのアナリストは、引き続きアマゾンドットコムに買いの評価を維持し、$224の目標株価を目指しています。 | $180.00 | 49.3千ドル | 1.1K | 45 |

| AMZN | プット | 取引 | 強気 | 01/17/25 | 9.65ドル

| $9.45 | 9.53ドル | 170.00ドル | $38.1K | 16.3K | 0 |

| AMZN | コール | 取引 | 強気 | 09/13/24 | $7.3 | $7.15 | $7.3 | 170.00ドル | 37.2Kドル | 1.1K | 0 |

アマゾンドットコムについて

Amazonは、第三者の売り手向けの主要なオンライン小売りとマーケットプレイスです。小売関連売上高は総売上高の約75%を占め、Amazon Web Servicesのクラウドコンピューティング、ストレージ、データベース、その他のサービス(15%)、広告サービス(5%-10%)、残りのサービス(その他)を続きます。国際部門は25%〜30%が非AWS売上高を占め、ドイツ、イギリス、日本をリードしています。

Amazon.comは今どこに立っていますか?

- RSI指標によると、株は現在、オーバーボートとオーバーソールドの間でニュートラル状態です。

全体の取引から、プットオプションが7つあり、合計金額は$245,612であり、コールオプションが5つあり、合計金額は$317,267です。

全体の取引から、プットオプションが7つあり、合計金額は$245,612であり、コールオプションが5つあり、合計金額は$317,267です。

From the overall spotted trades, 7 are puts, for a total amount of $245,612 and 5, calls, for a total amount of $317,267.

From the overall spotted trades, 7 are puts, for a total amount of $245,612 and 5, calls, for a total amount of $317,267.