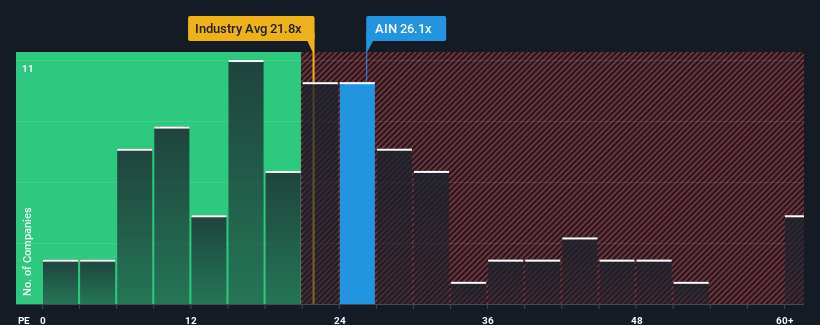

With a price-to-earnings (or "P/E") ratio of 26.1x Albany International Corp. (NYSE:AIN) may be sending bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 10x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Albany International as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Does Growth Match The High P/E?

Albany International's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered an exceptional 33% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 2.4% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Retrospectively, the last year delivered an exceptional 33% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 2.4% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 16% during the coming year according to the five analysts following the company. That's shaping up to be similar to the 15% growth forecast for the broader market.

With this information, we find it interesting that Albany International is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Albany International's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Albany International's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Albany International with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.