To the annoyance of some shareholders, JW (Cayman) Therapeutics Co. Ltd (HKG:2126) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

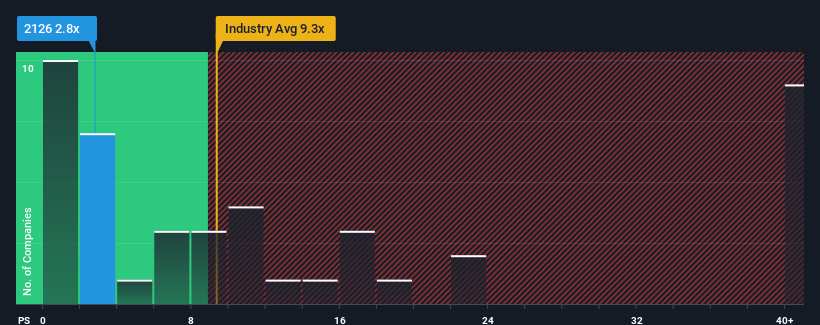

Following the heavy fall in price, JW (Cayman) Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.8x, considering almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios greater than 9.3x and even P/S higher than 21x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

What Does JW (Cayman) Therapeutics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, JW (Cayman) Therapeutics has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on JW (Cayman) Therapeutics.Is There Any Revenue Growth Forecasted For JW (Cayman) Therapeutics?

JW (Cayman) Therapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

JW (Cayman) Therapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 56% per year during the coming three years according to the two analysts following the company. With the industry only predicted to deliver 44% per year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that JW (Cayman) Therapeutics' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Having almost fallen off a cliff, JW (Cayman) Therapeutics' share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at JW (Cayman) Therapeutics' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 2 warning signs for JW (Cayman) Therapeutics you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.