Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Fushun Special Steel Co.,LTD. (SHSE:600399) investors who have held the stock for three years as it declined a whopping 82%. That would be a disturbing experience. And the ride hasn't got any smoother in recent times over the last year, with the price 48% lower in that time. Shareholders have had an even rougher run lately, with the share price down 21% in the last 90 days. But this could be related to the weak market, which is down 12% in the same period. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, Fushun Special SteelLTD's earnings per share (EPS) dropped by 14% each year. This reduction in EPS is slower than the 43% annual reduction in the share price. So it seems the market was too confident about the business, in the past.

During the three years that the share price fell, Fushun Special SteelLTD's earnings per share (EPS) dropped by 14% each year. This reduction in EPS is slower than the 43% annual reduction in the share price. So it seems the market was too confident about the business, in the past.

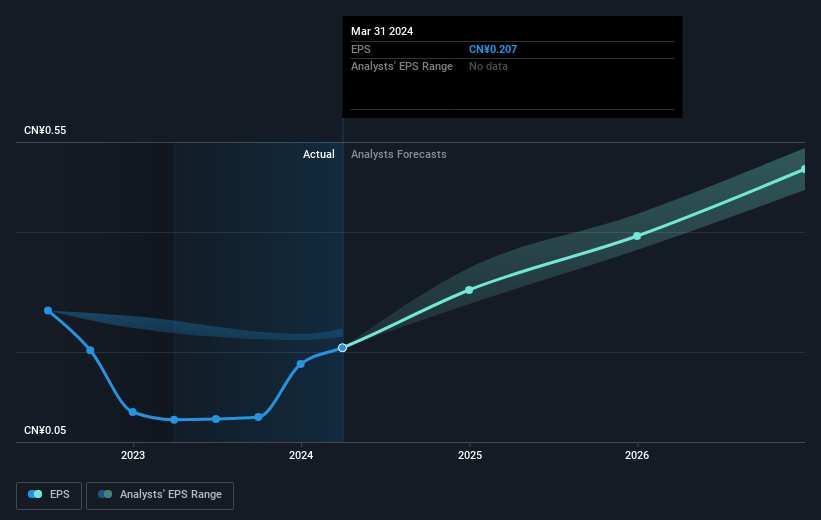

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Fushun Special SteelLTD has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

We regret to report that Fushun Special SteelLTD shareholders are down 47% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 16%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 11%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Fushun Special SteelLTD is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.