To the annoyance of some shareholders, Vasta Platform Limited (NASDAQ:VSTA) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

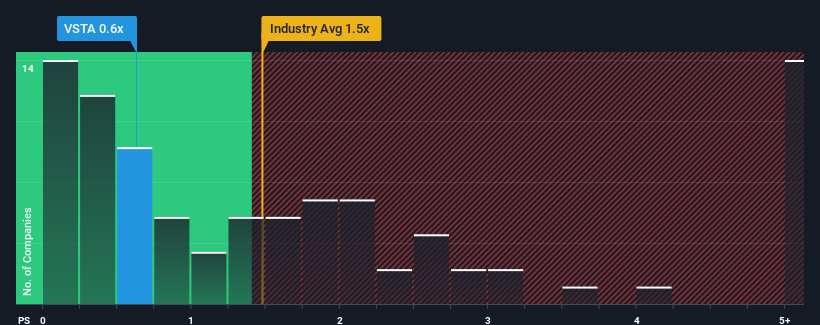

Following the heavy fall in price, when close to half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.5x, you may consider Vasta Platform as an enticing stock to check out with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Vasta Platform Performed Recently?

With revenue growth that's inferior to most other companies of late, Vasta Platform has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Vasta Platform will help you uncover what's on the horizon.How Is Vasta Platform's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Vasta Platform's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Vasta Platform's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 15%. The latest three year period has also seen an excellent 73% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 13% as estimated by the four analysts watching the company. With the industry predicted to deliver 13% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that Vasta Platform is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Vasta Platform's P/S Mean For Investors?

The southerly movements of Vasta Platform's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for Vasta Platform remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Vasta Platform with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Vasta Platform's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.