Zhongtong Bus Holding Co.,LTD (SZSE:000957) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 13% share price drop.

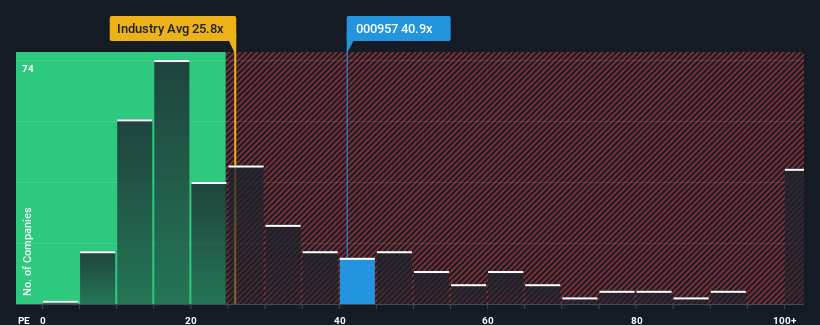

Even after such a large drop in price, Zhongtong Bus HoldingLTD's price-to-earnings (or "P/E") ratio of 40.9x might still make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 25x and even P/E's below 15x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We'd have to say that with no tangible growth over the last year, Zhongtong Bus HoldingLTD's earnings have been unimpressive. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

How Is Zhongtong Bus HoldingLTD's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Zhongtong Bus HoldingLTD's to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like Zhongtong Bus HoldingLTD's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Comparing that to the market, which is predicted to deliver 37% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it concerning that Zhongtong Bus HoldingLTD is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Even after such a strong price drop, Zhongtong Bus HoldingLTD's P/E still exceeds the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Zhongtong Bus HoldingLTD revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Zhongtong Bus HoldingLTD, and understanding should be part of your investment process.

If you're unsure about the strength of Zhongtong Bus HoldingLTD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.