Deep-pocketed investors have adopted a bearish approach towards Oracle (NYSE:ORCL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ORCL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Oracle. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 61% bearish. Among these notable options, 6 are puts, totaling $320,495, and 7 are calls, amounting to $354,071.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.

Volume & Open Interest Trends

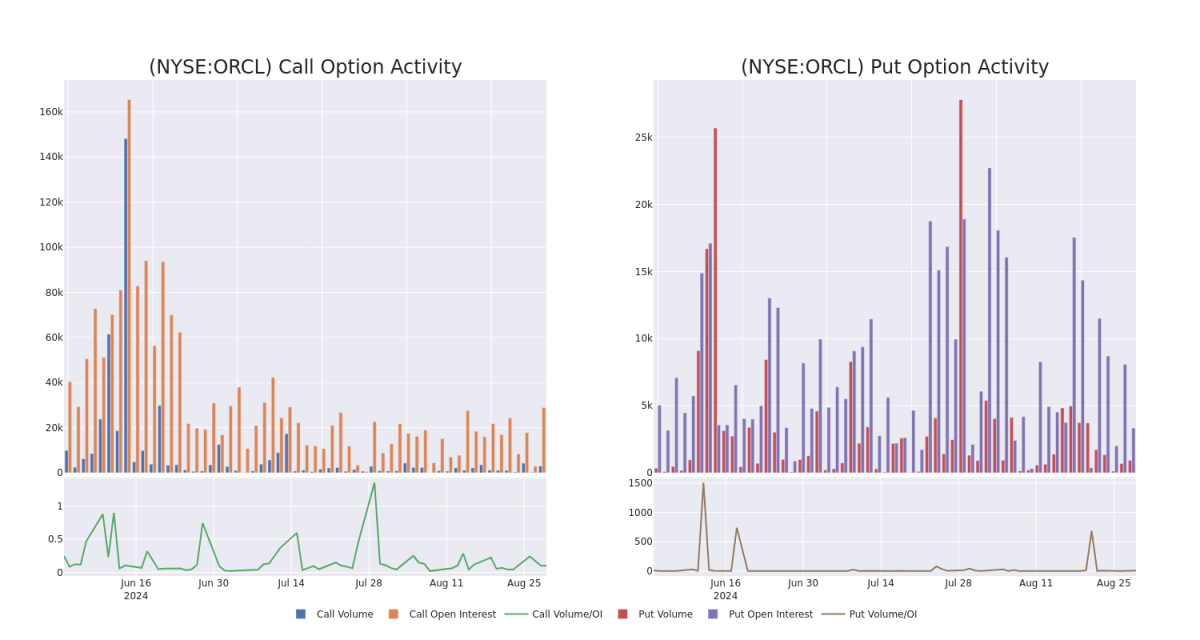

In today's trading context, the average open interest for options of Oracle stands at 3231.0, with a total volume reaching 3,910.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Oracle, situated within the strike price corridor from $120.0 to $145.0, throughout the last 30 days.

Oracle Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| ORCL | PUT | SWEEP | BEARISH | 09/13/24 | $6.45 | $6.35 | $6.4 | $142.00 | $83.2K | 30 | 5 |

| ORCL | CALL | SWEEP | NEUTRAL | 08/30/24 | $1.41 | $1.35 | $1.42 | $140.00 | $80.1K | 3.8K | 1.8K |

| ORCL | PUT | SWEEP | BEARISH | 01/17/25 | $7.55 | $7.5 | $7.55 | $135.00 | $70.9K | 1.4K | 97 |

| ORCL | CALL | SWEEP | BEARISH | 08/30/24 | $1.9 | $1.81 | $1.81 | $140.00 | $60.8K | 3.8K | 869 |

| ORCL | CALL | TRADE | BULLISH | 09/20/24 | $9.5 | $8.1 | $9.43 | $135.00 | $58.4K | 6.5K | 12 |

About Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Having examined the options trading patterns of Oracle, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Oracle's Current Market Status

- Trading volume stands at 1,299,549, with ORCL's price up by 1.82%, positioned at $140.39.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 11 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

Deep-pocketed investors have adopted a bearish approach towards Oracle (nyse:ORCL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ORCL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Oracle. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning 強気 and 61% 弱気. Among these notable options, 6 are puts, totaling $320,495, and 7 are calls, amounting to $354,071.

目標株価は何ですか?

Analyzing the 出来高 and 建玉 in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.

Analyzing the 出来高 and 建玉 in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.

出来高と建玉のトレンド

In today's 取引 context, the average 建玉 for オプション of Oracle stands at 3231.0, with a total 出来高 reaching 3,910.00. The accompanying chart delineates the progression of both コール and プット option 出来高 and 建玉 for high-value 取引 in Oracle, situated within the 権利行使価格 corridor from $120.0 to $145.0, throughout the last 30 days.

Oracle コール and プット 出来高: 30-Day Overview

検出された重要なオプション取引:

| シンボル | プット/コール | 取引タイプ | センチメント | 権利行使日 | 売気配 | 買気配 | 価格 | 権利行使価格 | トータル取引価格 | 建玉 | 出来高 |

|---|

| オラクル | プット | スイープ | 弱気 | 09/13/24 | $6.45 | $6.35 | $6.4 | $142.00 | $83.2千 | Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Bank of America options trades with real-time alerts from Benzinga Pro. | 5 |

| オラクル | コール | スイープ | ニュートラル | 08/30/24 | 1.41ドル | $1.35 | $1.42 | $140.00 | $80.1K | 3.8K | 1.8K |

| オラクル | プット | スイープ | 弱気 | 01/17/25 | $7.55 | $7.5 | $7.55 | $135.00 | $70.9K | 1.4K | 97 |

| オラクル | コール | スイープ | 弱気 | 08/30/24 | 1.9ドル | $1.81 | $1.81 | $140.00 | $60.8K | 3.8K | 869 |

| オラクル | コール | 取引 | 強気 | 09/20/24 | 9.5ドル | $8.1 | $9.43 | $135.00 | $58.4K | 6.5K | $78.3 |

Oracleについて

- RSI指標は、この株式がオーバーバイトに近づいている可能性があることを示しています。

- 11日後には収益発表が予定されています。

オプションは、株式だけを取引するよりもリスキーな資産ですが、より高い利益ポテンシャルがあります。真剣なオプショントレーダーは、毎日自己教育を行い、トレードをスケーリングイン・スケーリングアウトし、2つ以上のインジケーターをフォローし、市場を密接に追いかけることでこのリスクを管理します。

Analyzing the 出来高 and 建玉 in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.

Analyzing the 出来高 and 建玉 in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $145.0 for Oracle during the past quarter.