The Hansoh Pharmaceutical Group Company Limited (HKG:3692) share price has done very well over the last month, posting an excellent gain of 27%. The last month tops off a massive increase of 104% in the last year.

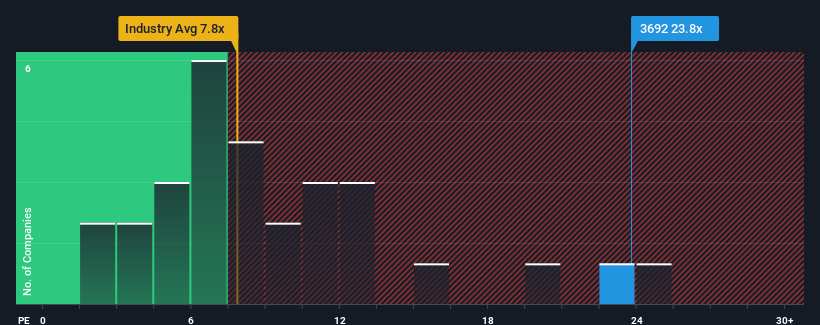

Following the firm bounce in price, Hansoh Pharmaceutical Group's price-to-earnings (or "P/E") ratio of 23.8x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 8x and even P/E's below 5x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Hansoh Pharmaceutical Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

How Is Hansoh Pharmaceutical Group's Growth Trending?

In order to justify its P/E ratio, Hansoh Pharmaceutical Group would need to produce outstanding growth well in excess of the market.

In order to justify its P/E ratio, Hansoh Pharmaceutical Group would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 83% last year. Pleasingly, EPS has also lifted 79% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 2.4% per annum during the coming three years according to the analysts following the company. Meanwhile, the broader market is forecast to expand by 14% per year, which paints a poor picture.

In light of this, it's alarming that Hansoh Pharmaceutical Group's P/E sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has got Hansoh Pharmaceutical Group's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Hansoh Pharmaceutical Group's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Hansoh Pharmaceutical Group you should be aware of.

If these risks are making you reconsider your opinion on Hansoh Pharmaceutical Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.