Key Insights

- Medicskin Holdings to hold its Annual General Meeting on 6th of September

- Salary of HK$4.22m is part of CEO Kwok Leung Kong's total remuneration

- Total compensation is 340% above industry average

- Medicskin Holdings' EPS declined by 91% over the past three years while total shareholder loss over the past three years was 52%

Shareholders will probably not be too impressed with the underwhelming results at Medicskin Holdings Limited (HKG:8307) recently. At the upcoming AGM on 6th of September, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. We present the case why we think CEO compensation is out of sync with company performance.

How Does Total Compensation For Kwok Leung Kong Compare With Other Companies In The Industry?

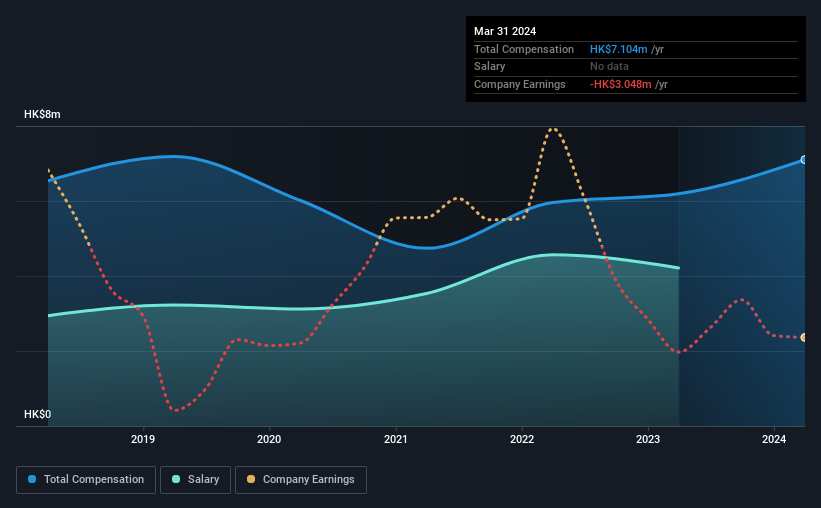

According to our data, Medicskin Holdings Limited has a market capitalization of HK$52m, and paid its CEO total annual compensation worth HK$7.1m over the year to March 2024. We note that's an increase of 15% above last year. We note that the salary of HK$4.22m makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar-sized companies in the Hong Kong Healthcare industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.6m. This suggests that Kwok Leung Kong is paid more than the median for the industry. Furthermore, Kwok Leung Kong directly owns HK$36m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$4.2m | HK$4.6m | 59% |

| Other | HK$2.9m | HK$1.6m | 41% |

| Total Compensation | HK$7.1m | HK$6.2m | 100% |

On an industry level, around 72% of total compensation represents salary and 28% is other remuneration. In Medicskin Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

On an industry level, around 72% of total compensation represents salary and 28% is other remuneration. In Medicskin Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Medicskin Holdings Limited's Growth Numbers

Over the last three years, Medicskin Holdings Limited has shrunk its earnings per share by 91% per year. Its revenue is up 8.4% over the last year.

The decline in EPS is a bit concerning. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Medicskin Holdings Limited Been A Good Investment?

With a total shareholder return of -52% over three years, Medicskin Holdings Limited shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Medicskin Holdings that investors should think about before committing capital to this stock.

Important note: Medicskin Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.