Unfortunately for some shareholders, the MedSci Healthcare Holdings Limited (HKG:2415) share price has dived 34% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 73% loss during that time.

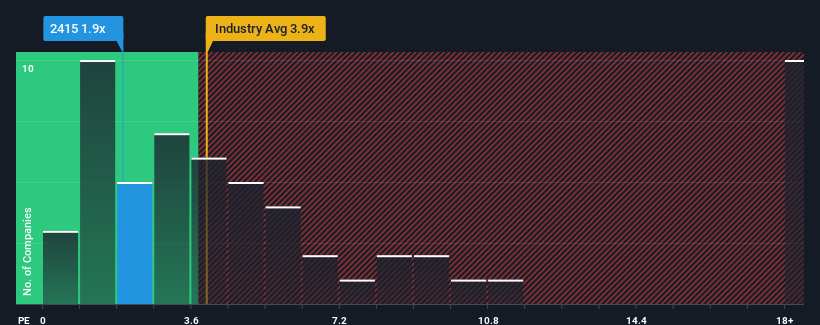

Even after such a large drop in price, when around half the companies operating in Hong Kong's Healthcare Services industry have price-to-sales ratios (or "P/S") above 4.3x, you may still consider MedSci Healthcare Holdings as an incredibly enticing stock to check out with its 1.9x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How MedSci Healthcare Holdings Has Been Performing

With revenue growth that's inferior to most other companies of late, MedSci Healthcare Holdings has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think MedSci Healthcare Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is MedSci Healthcare Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like MedSci Healthcare Holdings' to be considered reasonable.

There's an inherent assumption that a company should far underperform the industry for P/S ratios like MedSci Healthcare Holdings' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 62% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 611% each year over the next three years. That's shaping up to be materially higher than the 178% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that MedSci Healthcare Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does MedSci Healthcare Holdings' P/S Mean For Investors?

Shares in MedSci Healthcare Holdings have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at MedSci Healthcare Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with MedSci Healthcare Holdings (including 1 which doesn't sit too well with us).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.