When companies post strong earnings, the stock generally performs well, just like Wangli Security & Surveillance Product Co., Ltd's (SHSE:605268) stock has recently. Our analysis found some more factors that we think are good for shareholders.

How Do Unusual Items Influence Profit?

To properly understand Wangli Security & Surveillance Product's profit results, we need to consider the CN¥13m expense attributed to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. If Wangli Security & Surveillance Product doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

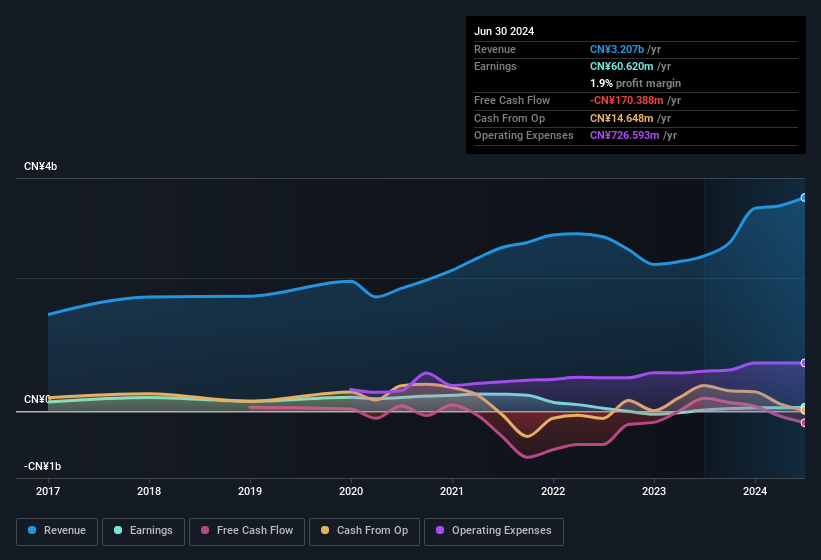

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Wangli Security & Surveillance Product's Profit Performance

Because unusual items detracted from Wangli Security & Surveillance Product's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Because of this, we think Wangli Security & Surveillance Product's earnings potential is at least as good as it seems, and maybe even better! Furthermore, it has done a great job growing EPS over the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, we've discovered 1 warning sign that you should run your eye over to get a better picture of Wangli Security & Surveillance Product.

Because unusual items detracted from Wangli Security & Surveillance Product's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Because of this, we think Wangli Security & Surveillance Product's earnings potential is at least as good as it seems, and maybe even better! Furthermore, it has done a great job growing EPS over the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, we've discovered 1 warning sign that you should run your eye over to get a better picture of Wangli Security & Surveillance Product.

Today we've zoomed in on a single data point to better understand the nature of Wangli Security & Surveillance Product's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.