While it may not be enough for some shareholders, we think it is good to see the Jiangxi Hongdu Aviation Industry Co., Ltd. (SHSE:600316) share price up 13% in a single quarter. But that is small recompense for the exasperating returns over three years. In that time, the share price dropped 51%. So it is really good to see an improvement. Perhaps the company has turned over a new leaf.

On a more encouraging note the company has added CN¥1.2b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

While Jiangxi Hongdu Aviation Industry made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last three years, Jiangxi Hongdu Aviation Industry's revenue dropped 15% per year. That's definitely a weaker result than most pre-profit companies report. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 15% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

Over the last three years, Jiangxi Hongdu Aviation Industry's revenue dropped 15% per year. That's definitely a weaker result than most pre-profit companies report. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 15% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

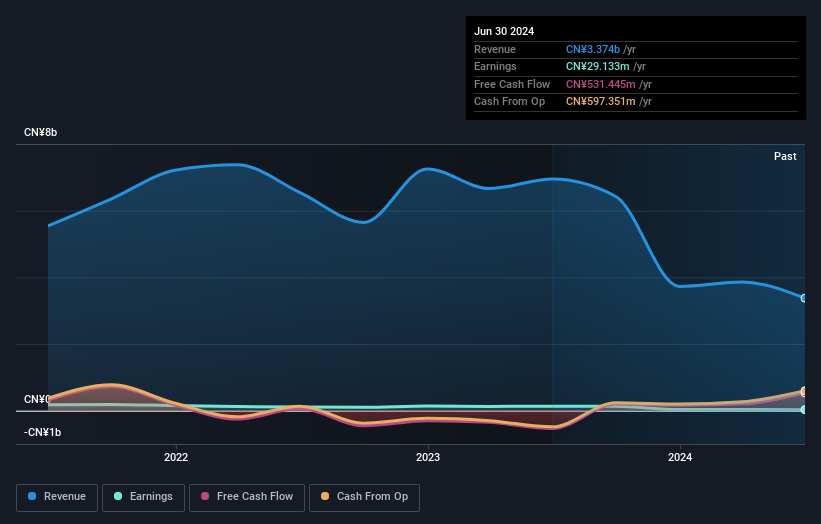

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Jiangxi Hongdu Aviation Industry's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's never nice to take a loss, Jiangxi Hongdu Aviation Industry shareholders can take comfort that , including dividends,their trailing twelve month loss of 0.9% wasn't as bad as the market loss of around 20%. Longer term investors wouldn't be so upset, since they would have made 5%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Jiangxi Hongdu Aviation Industry (1 doesn't sit too well with us) that you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.