Those holding Seanergy Maritime Holdings Corp. (NASDAQ:SHIP) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last month tops off a massive increase of 112% in the last year.

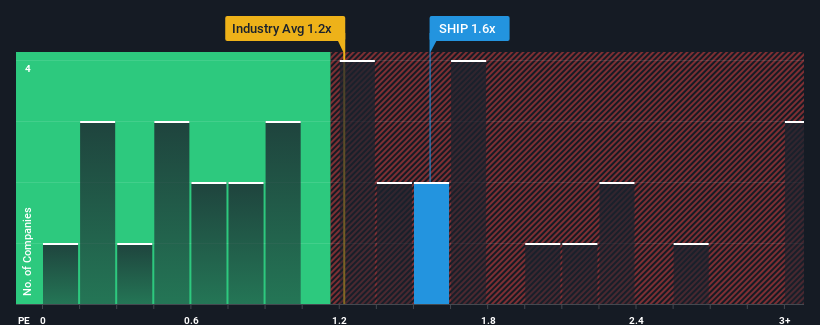

Even after such a large jump in price, it's still not a stretch to say that Seanergy Maritime Holdings' price-to-sales (or "P/S") ratio of 1.6x right now seems quite "middle-of-the-road" compared to the Shipping industry in the United States, where the median P/S ratio is around 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has Seanergy Maritime Holdings Performed Recently?

Seanergy Maritime Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Seanergy Maritime Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Seanergy Maritime Holdings' Revenue Growth Trending?

Seanergy Maritime Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 33% last year. The latest three year period has also seen an excellent 63% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 13% during the coming year according to the four analysts following the company. That would be an excellent outcome when the industry is expected to decline by 0.02%.

In light of this, it's peculiar that Seanergy Maritime Holdings' P/S sits in-line with the majority of other companies. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What Does Seanergy Maritime Holdings' P/S Mean For Investors?

Its shares have lifted substantially and now Seanergy Maritime Holdings' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We note that even though Seanergy Maritime Holdings trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Seanergy Maritime Holdings is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.