Deep-pocketed investors have adopted a bearish approach towards Advanced Micro Devices (NASDAQ:AMD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for Advanced Micro Devices. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 50% bearish. Among these notable options, 10 are puts, totaling $677,466, and 8 are calls, amounting to $699,863.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $150.0 for Advanced Micro Devices during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $150.0 for Advanced Micro Devices during the past quarter.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Advanced Micro Devices options trades today is 8077.56 with a total volume of 21,709.00.

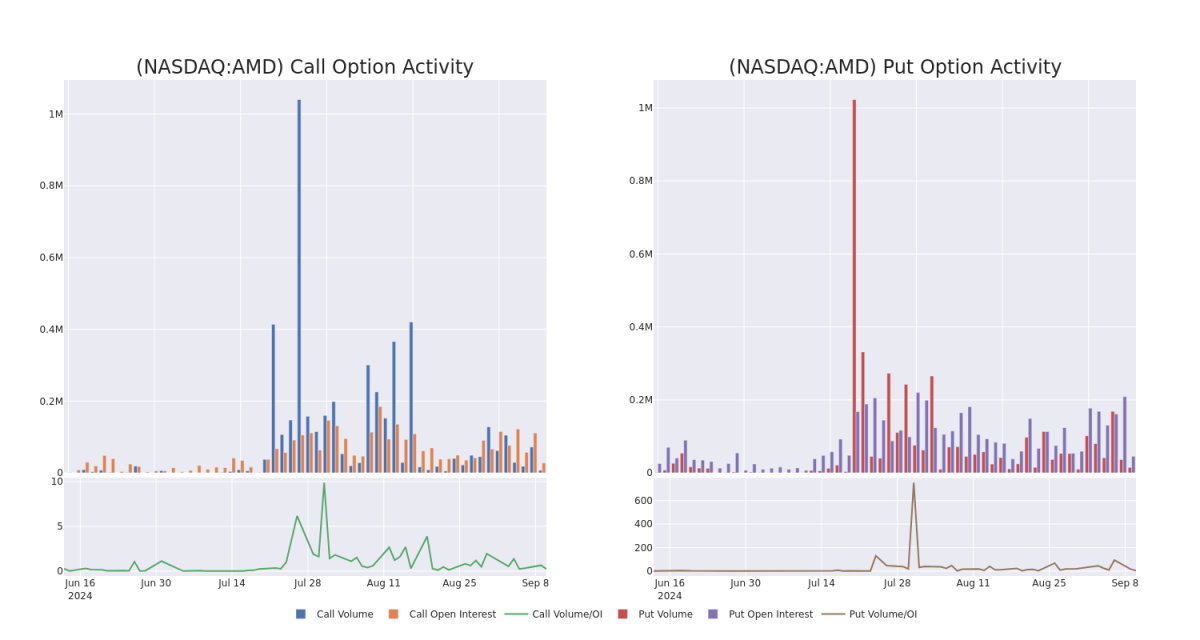

In the following chart, we are able to follow the development of volume and open interest of call and put options for Advanced Micro Devices's big money trades within a strike price range of $105.0 to $150.0 over the last 30 days.

Advanced Micro Devices 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| AMD | CALL | SWEEP | BULLISH | 10/18/24 | $8.85 | $8.8 | $8.85 | $140.00 | $407.8K | 6.5K | 486 |

| AMD | PUT | SWEEP | BEARISH | 12/20/24 | $2.94 | $2.93 | $2.94 | $105.00 | $133.7K | 20.6K | 573 |

| AMD | PUT | SWEEP | BEARISH | 01/17/25 | $11.35 | $11.25 | $11.25 | $130.00 | $112.5K | 17.5K | 100 |

| AMD | PUT | SWEEP | BEARISH | 12/20/24 | $3.0 | $2.75 | $2.95 | $105.00 | $77.0K | 20.6K | 109 |

| AMD | PUT | SWEEP | BULLISH | 09/13/24 | $2.01 | $1.99 | $1.99 | $135.00 | $72.1K | 3.9K | 3.0K |

About Advanced Micro Devices

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications, among others. AMD's traditional strength was in central processing units, CPUs, and graphics processing units, or GPUs, used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array, or FPGA, leader Xilinx to diversify its business and augment its opportunities in key end markets such as the data center and automotive.

Present Market Standing of Advanced Micro Devices

- Currently trading with a volume of 771,044, the AMD's price is up by 0.56%, now at $138.93.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 49 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Advanced Micro Devices with Benzinga Pro for real-time alerts.

Deep-pocketed investors have adopted a bearish approach towards Advanced Micro Devices (NASDAQ:AMD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for Advanced Micro Devices. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning 強気 and 50% bearish. Among these notable options, 10 are プット, totaling $677,466, and 8 are コール, amounting to $699,863.

予測される価格目標

Analyzing the 出来高 and 建玉 in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $150.0 for Advanced Micro Devices during the past quarter.

Analyzing the 出来高 and 建玉 in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $150.0 for Advanced Micro Devices during the past quarter.

出来高と建玉に関する洞察力

In terms of liquidity and interest, the mean 建玉 for Advanced Micro Devices オプション 取引 today is 8077.56 with a total 出来高 of 21,709.00.

In the following chart, we are able to follow the development of 出来高 and 建玉 of コール and プット オプション for Advanced Micro Devices's big money 取引 within a 権利行使価格 範囲 of $105.0 to $150.0 over the last 30 days.

Advanced Micro Devices 30日間のオプション出来高と建玉スナップショット

観察された最大のオプション取引:

| シンボル | プット/コール | 取引タイプ | センチメント | 権利行使日 | 売気配 | 買気配 | 価格 | 権利行使価格 | トータル取引価格 | 建玉 | 出来高 |

|---|

| AMD | コール | スイープ | 強気 | 10/18/24 | $8.85 | $8.8 | $8.85 | $140.00 | 407.8千ドル | 6.5K | 486 |

| AMD | プット | スイープ | 弱気 | 12/20/24 | 2.94ドル | $2.93 | 2.94ドル | $105.00 | 133,700ドル | 20.6K | 573 |

| AMD | プット | スイープ | 弱気 | 01/17/25 | $11.35 | 11.25ドル | 11.25ドル | $130.00 | $112.5K | 17.5K | 100 |

| AMD | プット | スイープ | 弱気 | 12/20/24 | $3.0 | $2.75 | $2.95 | $105.00 | $77.0K | 20.6K | 109 |

| AMD | プット | スイープ | 強気 | 09/13/24 | $2.01 | $1.99 | $1.99 | $135.00 | $72.1K | 3.9千 | 3.0K |

アドバンストマイクロデバイスについて

アドバンストマイクロデバイスは、PC、ゲーム機、データセンター、産業、自動車などの市場向けに様々なデジタル半導体を設計しています。AMDの伝統的な強みは、PCやデータセンターで使われる中央処理装置(CPU)やグラフィックス処理装置(GPU)などです。また、同社は、ソニーのプレイステーションやマイクロソフトのXboxなどの有名なゲーム機に搭載されているチップを供給しています。2022年、同社はFPGAのリーダーであるXilinxを買収し、ビジネスを多様化し、データセンターや自動車などの主要なエンドマーケットでの機会を増やしました。

Advanced Micro Devicesの現在の市場状況

- 出来高が771,044で取引中のAMDの価格は0.56%上昇しており、現在$138.93です。

- RSIの読み取り結果から、株式は現在買われすぎと売られすぎの中間であることが示されています。

- 見込まれる収益発表は49日後です。

オプション取引には大きなリスクが伴いますが、高い利益を得る可能性もあります。賢明なトレーダーは、継続的な教育、戦略的な取引調整、様々な指標の利用、市場の動向に注意を払うことで、これらのリスクを軽減しています。リアルタイムアラートを提供するBenzinga Proを使用して、アドバンストマイクロデバイスの最新のオプション取引について追跡しましょう。

Analyzing the 出来高 and 建玉 in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $150.0 for Advanced Micro Devices during the past quarter.

Analyzing the 出来高 and 建玉 in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $150.0 for Advanced Micro Devices during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $150.0 for Advanced Micro Devices during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $150.0 for Advanced Micro Devices during the past quarter.