Deep-pocketed investors have adopted a bearish approach towards Occidental Petroleum (NYSE:OXY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in OXY usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 22 extraordinary options activities for Occidental Petroleum. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 31% leaning bullish and 59% bearish. Among these notable options, 11 are puts, totaling $615,605, and 11 are calls, amounting to $478,964.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $30.0 to $60.0 for Occidental Petroleum over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $30.0 to $60.0 for Occidental Petroleum over the last 3 months.

Insights into Volume & Open Interest

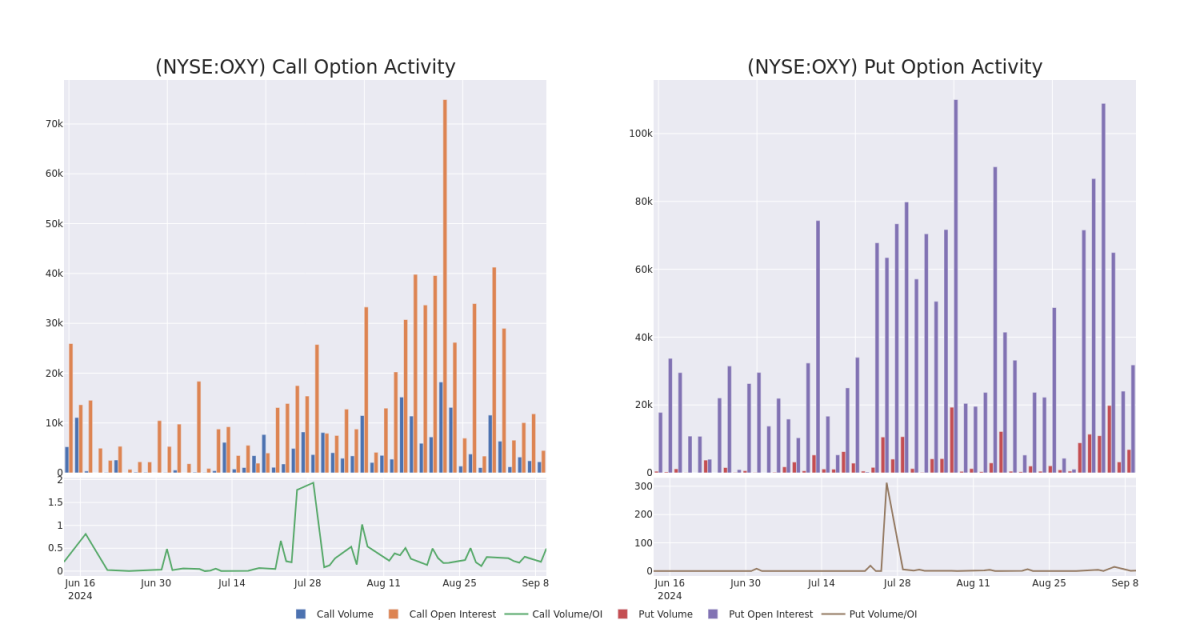

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Occidental Petroleum's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Occidental Petroleum's whale trades within a strike price range from $30.0 to $60.0 in the last 30 days.

Occidental Petroleum Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | PUT | TRADE | BEARISH | 01/16/26 | $11.15 | $10.85 | $11.15 | $60.00 | $111.5K | 6.4K | 101 |

| OXY | PUT | SWEEP | BULLISH | 01/16/26 | $10.95 | $10.85 | $10.93 | $60.00 | $109.3K | 6.4K | 201 |

| OXY | PUT | TRADE | BEARISH | 12/20/24 | $2.38 | $2.33 | $2.36 | $50.00 | $80.7K | 3.9K | 401 |

| OXY | CALL | TRADE | BEARISH | 10/11/24 | $7.5 | $7.2 | $7.2 | $45.00 | $72.0K | 1 | 0 |

| OXY | CALL | TRADE | BEARISH | 12/18/26 | $6.15 | $6.0 | $6.0 | $60.00 | $60.0K | 668 | 105 |

About Occidental Petroleum

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

In light of the recent options history for Occidental Petroleum, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Occidental Petroleum

- Currently trading with a volume of 7,555,937, the OXY's price is down by -1.74%, now at $51.05.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 56 days.

What Analysts Are Saying About Occidental Petroleum

3 market experts have recently issued ratings for this stock, with a consensus target price of $71.0.

- An analyst from Susquehanna persists with their Positive rating on Occidental Petroleum, maintaining a target price of $78.

- Maintaining their stance, an analyst from Truist Securities continues to hold a Hold rating for Occidental Petroleum, targeting a price of $65.

- An analyst from UBS has decided to maintain their Neutral rating on Occidental Petroleum, which currently sits at a price target of $70.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.