The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

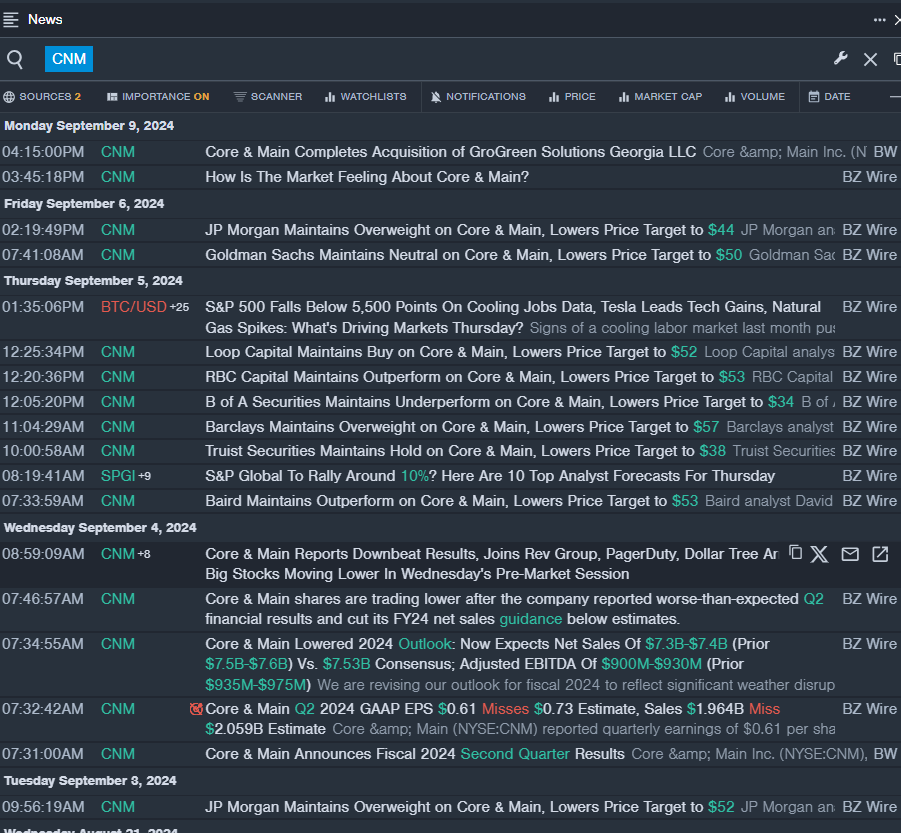

Core & Main Inc (NYSE:CNM)

- On Sept. 4, Core & Main reported worse-than-expected second-quarter financial results and cut its FY24 net sales guidance below estimates. Core & Main reported quarterly earnings of 61 cents per share which missed the analyst consensus estimate of 73 cents per share. The company reported quarterly sales of $1.964 billion which missed the analyst consensus estimate of $2.059 billion.. The company's stock fell around 22% over the past month and has a 52-week low of $27.75.

- RSI Value: 25.50

- CNM Price Action: Shares of Core & Main fell 0.5% to close at $38.12 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest CNM news.

Avis Budget Group Inc (NASDAQ:CAR)

- On Sept. 10, Avis Budget Group announced the pricing of $700 million of senior notes. The company's stock fell around 19% over the past month It has a 52-week low of $65.73.

- RSI Value: 26.27

- CAR Price Action: Shares of Avis Budget fell 3.2% to close at $67.43 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in CAR stock.

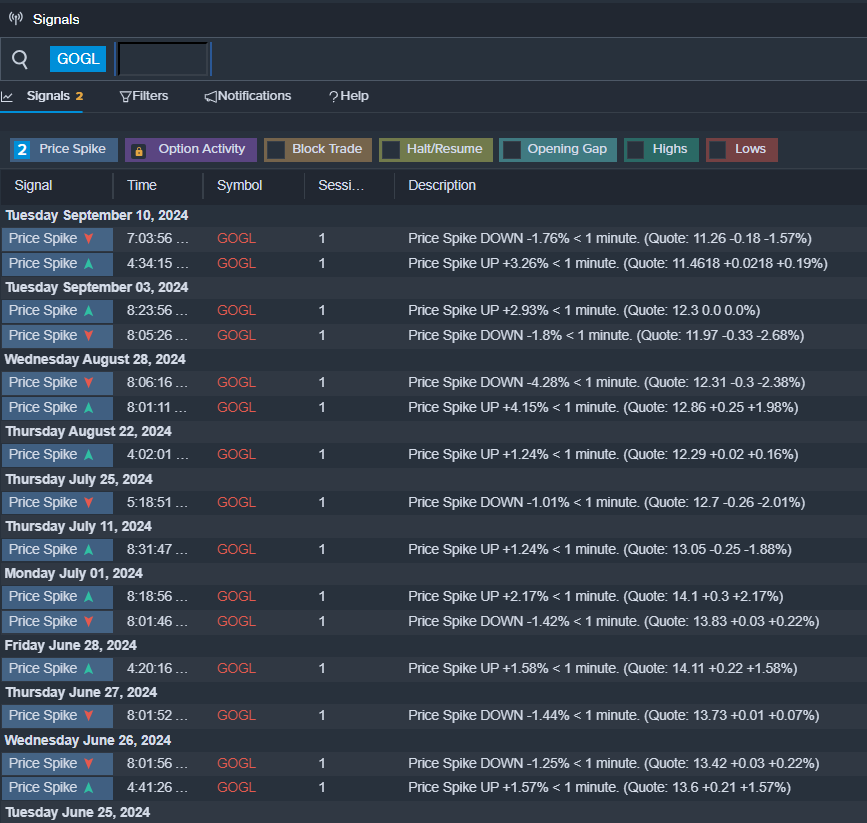

Golden Ocean Group Ltd (NASDAQ:GOGL)

- On Aug. 28, Golden Ocean Group posted better-than-expected quarterly earnings. Peder Simonsen, Interim Chief Executive Officer and Chief Financial Officer, commented, "Despite a volatile macro and geopolitical backdrop, the dry bulk shipping market remains healthy, and Golden Ocean continues to deliver above-market performance. This is attributable to the quality of our modern, fuel-efficient fleet as well as our strong commercial capabilities. While we continue to opportunistically secure charter coverage, we retain significant exposure to a market we believe will strengthen as the year progresses." The company's shares fell around 7% over the past month and has a 52-week low of $7.09.

- RSI Value: 29.58

- GOGL Price Action: Shares of Golden Ocean Group fell 3.3% to close at $11.06 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in GOGL shares.

Read Next:

- Jim Cramer Says AES Is 'Very Inexpensive', Recommends Buying This Industrial Stock