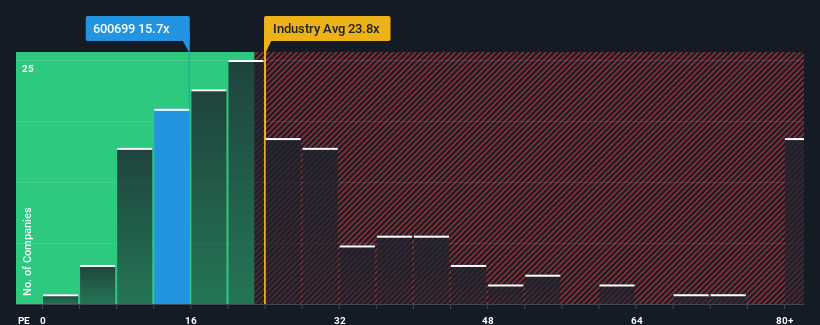

Ningbo Joyson Electronic Corp.'s (SHSE:600699) price-to-earnings (or "P/E") ratio of 15.7x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 27x and even P/E's above 51x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Ningbo Joyson Electronic as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Ningbo Joyson Electronic would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 24% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 18% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Retrospectively, the last year delivered an exceptional 24% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 18% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 19% per year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 20% per year growth forecast for the broader market.

In light of this, it's peculiar that Ningbo Joyson Electronic's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ningbo Joyson Electronic's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Ningbo Joyson Electronic is showing 3 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.