High-rolling investors have positioned themselves bullish on Gilead Sciences (NASDAQ:GILD), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GILD often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 19 options trades for Gilead Sciences. This is not a typical pattern.

The sentiment among these major traders is split, with 84% bullish and 15% bearish. Among all the options we identified, there was one put, amounting to $93,009, and 18 calls, totaling $1,310,925.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $85.0 for Gilead Sciences during the past quarter.

Analyzing Volume & Open Interest

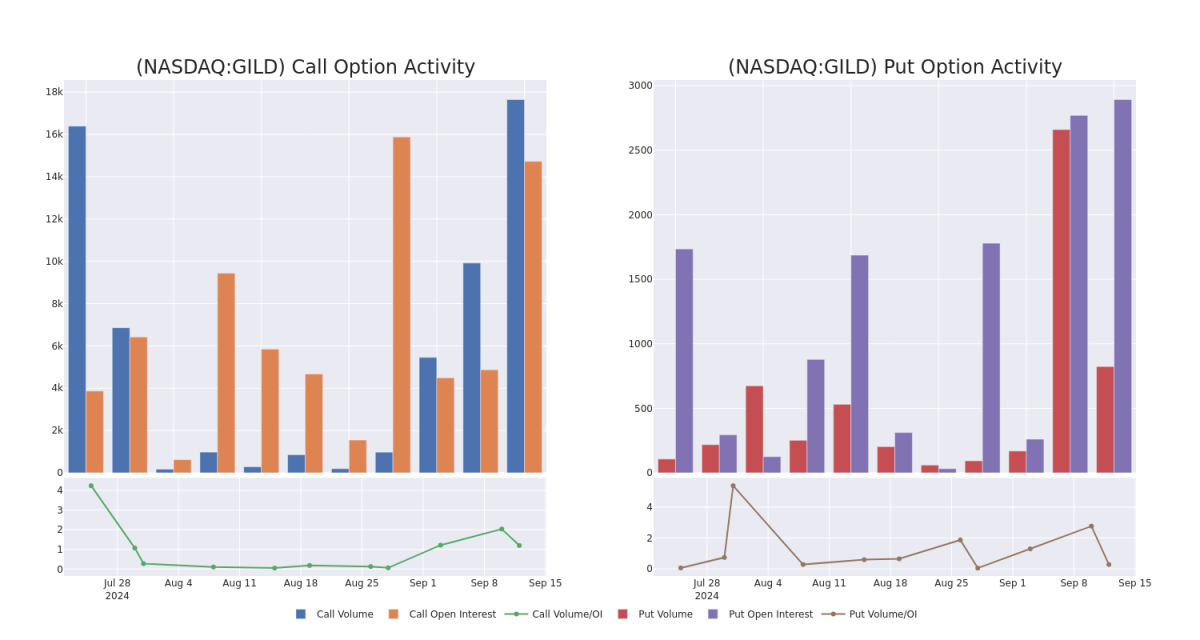

In today's trading context, the average open interest for options of Gilead Sciences stands at 2517.0, with a total volume reaching 18,469.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Gilead Sciences, situated within the strike price corridor from $75.0 to $85.0, throughout the last 30 days.

Gilead Sciences 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | CALL | SWEEP | BEARISH | 01/16/26 | $13.25 | $12.95 | $13.0 | $75.00 | $635.7K | 1.2K | 490 |

| GILD | CALL | TRADE | BULLISH | 11/15/24 | $8.45 | $8.3 | $8.45 | $75.00 | $190.9K | 1.5K | 239 |

| GILD | PUT | SWEEP | BULLISH | 10/18/24 | $1.29 | $1.25 | $1.29 | $80.00 | $93.0K | 2.8K | 824 |

| GILD | CALL | SWEEP | BULLISH | 09/20/24 | $2.8 | $2.71 | $2.8 | $80.00 | $55.8K | 10.5K | 2.2K |

| GILD | CALL | SWEEP | BEARISH | 09/20/24 | $1.39 | $1.15 | $1.15 | $83.00 | $45.9K | 142 | 927 |

About Gilead Sciences

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. Gilead's acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of newer combination regimens that remain standards of care. Gilead is also growing its presence in the oncology market via acquisitions, led by CAR-T cell therapy Yescarta/Tecartus (from Kite) and breast and bladder cancer therapy Trodelvy (from Immunomedics).

After a thorough review of the options trading surrounding Gilead Sciences, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Gilead Sciences

- With a trading volume of 4,190,255, the price of GILD is up by 2.2%, reaching $82.72.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 54 days from now.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.