Financial giants have made a conspicuous bullish move on Snap. Our analysis of options history for Snap (NYSE:SNAP) revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $196,000, and 6 were calls, valued at $368,332.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $7.0 to $15.0 for Snap over the last 3 months.

Insights into Volume & Open Interest

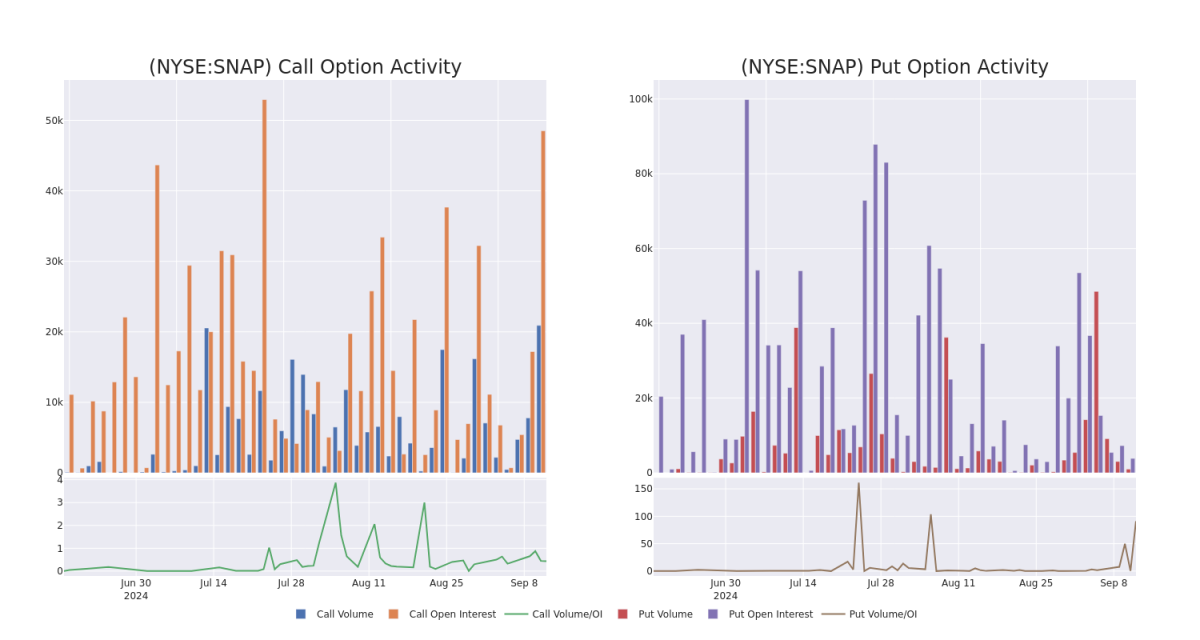

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Snap's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Snap's significant trades, within a strike price range of $7.0 to $15.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Snap's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Snap's significant trades, within a strike price range of $7.0 to $15.0, over the past month.

Snap Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | CALL | TRADE | NEUTRAL | 01/16/26 | $1.41 | $1.37 | $1.39 | $15.00 | $152.9K | 5.5K | 1.2K |

| SNAP | PUT | TRADE | NEUTRAL | 06/20/25 | $1.34 | $1.32 | $1.33 | $8.00 | $133.0K | 3.8K | 1.0K |

| SNAP | PUT | TRADE | BEARISH | 05/16/25 | $1.26 | $1.24 | $1.26 | $8.00 | $63.0K | 11 | 1.0K |

| SNAP | CALL | TRADE | BEARISH | 09/20/24 | $0.13 | $0.12 | $0.12 | $10.00 | $60.0K | 14.4K | 8.3K |

| SNAP | CALL | SWEEP | BULLISH | 09/20/24 | $0.23 | $0.22 | $0.22 | $9.50 | $52.8K | 24.5K | 4.5K |

About Snap

Snap owns one of the most popular social networking apps, Snapchat, claiming more than 400 million daily active users as of the end of 2023. Snap generates nearly all its revenue from advertising. While only about one quarter of users are in North America, the region accounts for about 65% of sales.

Following our analysis of the options activities associated with Snap, we pivot to a closer look at the company's own performance.

Snap's Current Market Status

- Trading volume stands at 22,481,473, with SNAP's price up by 3.89%, positioned at $9.35.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 40 days.

What Analysts Are Saying About Snap

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $8.0.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Neutral with a new price target of $8.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Snap options trades with real-time alerts from Benzinga Pro.