The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Tronox Holdings PLC (NYSE:TROX)

- On Aug. 1, Tronox Holdings reported worse-than-expected second-quarter financial results. The company's stock fell around 7% over the past five days and has a 52-week low of $10.08.

- RSI Value: 27.54

- TROX Price Action: Shares of Tronox fell 0.3% to close at $11.71 on Thursday.

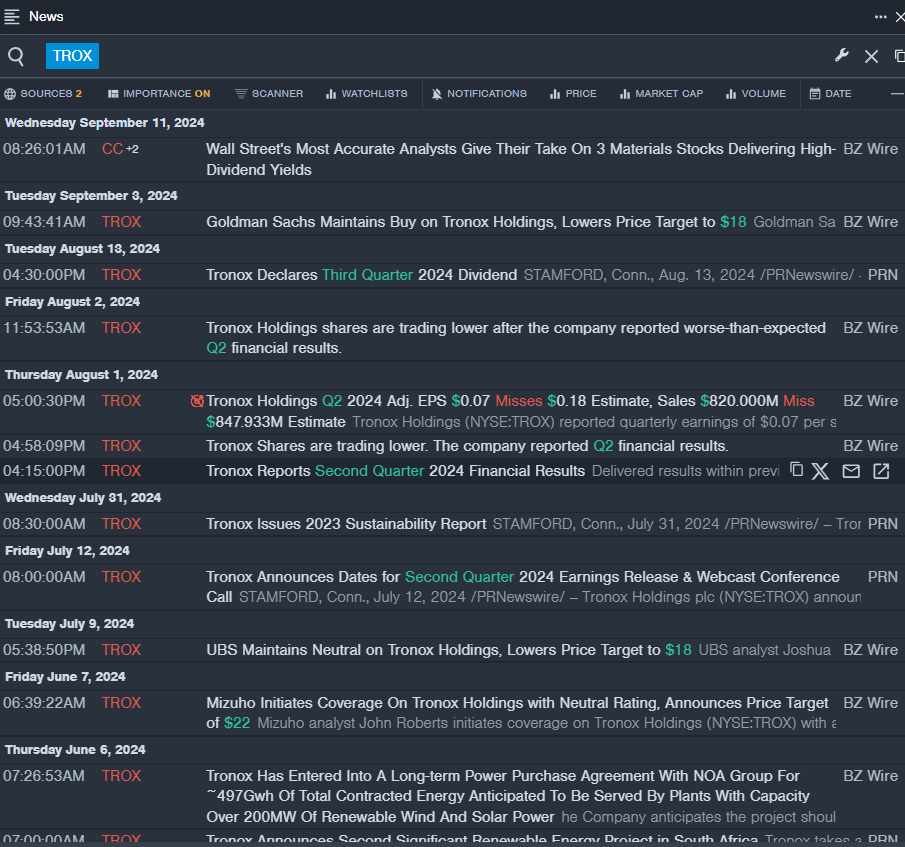

- Benzinga Pro's real-time newsfeed alerted to latest TROX news.

Clearwater Paper Corp (NYSE:CLW)

- On Aug. 6, Clearwater Paper reported quarterly losses of $1.55 per share. "We completed the acquisition of the Augusta facility in May and our integration is on track. We are pleased with the quality of the assets and are committed to achieving our targeted synergies by the end of 2026," said Arsen Kitch, president and chief executive officer. "Our tissue business continues to deliver outstanding performance, and we are expecting a gradual recovery in paperboard market demand in the coming quarters." The company's stock fell around 11% over the past month. It has a 52-week low of $27.69.

- RSI Value: 28.09

- CLW Price Action: Shares of Clearwater Paper rose 2.8% to close at $28.81 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in CLW stock.

Ascent Industries Co (NASDAQ:ACNT)

- On Aug. 6, Ascent Industries reported quarterly losses of 2 cents per share. The company reported quarterly sales of $50.189 million. "Our stabilization efforts and aggressive self-help have started to yield tangible results in Q2 2024, despite continued soft market conditions," said Ascent CEO Bryan Kitchen. "Our relentless efforts to reduce costs, improve strategic sourcing and optimize our product mix have led to a significant year-over-year improvement in adjusted EBITDA and bottom-line results, while also right-sizing the organization for long-term growth." The company's shares fell around 8% over the past five days and has a 52-week low of $7.27.

- RSI Value: 29.92

- ACNT Price Action: Shares of Ascent Industries fell 3.1% to close at $9.25 on Thursday.

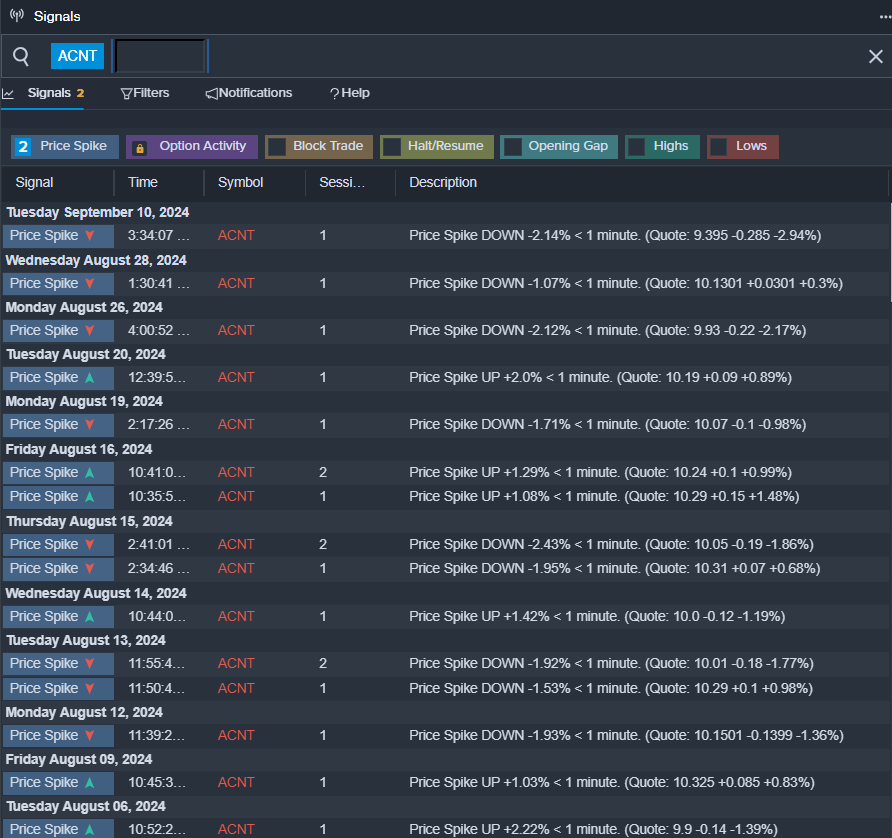

- Benzinga Pro's signals feature notified of a potential breakout in ACNT shares.

- Upstart, Insulet And 2 Other Stocks Executives Are Selling