It hasn't been the best quarter for Dawning Information Industry Co., Ltd. (SHSE:603019) shareholders, since the share price has fallen 16% in that time. But that doesn't change the fact that the returns over the last five years have been pleasing. Its return of 31% has certainly bested the market return!

Since the stock has added CN¥1.7b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

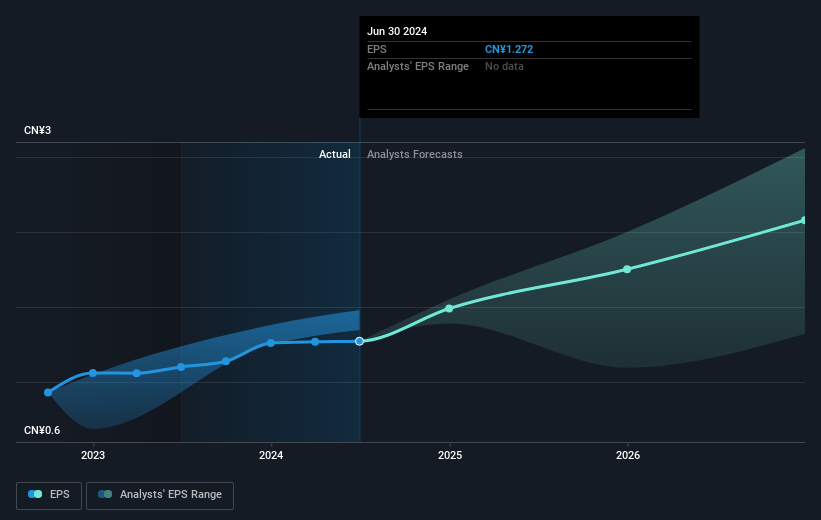

During five years of share price growth, Dawning Information Industry achieved compound earnings per share (EPS) growth of 27% per year. The EPS growth is more impressive than the yearly share price gain of 5% over the same period. Therefore, it seems the market has become relatively pessimistic about the company.

During five years of share price growth, Dawning Information Industry achieved compound earnings per share (EPS) growth of 27% per year. The EPS growth is more impressive than the yearly share price gain of 5% over the same period. Therefore, it seems the market has become relatively pessimistic about the company.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Dawning Information Industry has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Dawning Information Industry's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Dawning Information Industry's TSR of 34% over the last 5 years is better than the share price return.

A Different Perspective

Although it hurts that Dawning Information Industry returned a loss of 6.1% in the last twelve months, the broader market was actually worse, returning a loss of 19%. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Dawning Information Industry better, we need to consider many other factors. Take risks, for example - Dawning Information Industry has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.