Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Shenzhen Tongye Technology Co.,Ltd. (SZSE:300960) is about to go ex-dividend in just 3 days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. Meaning, you will need to purchase Shenzhen Tongye TechnologyLtd's shares before the 19th of September to receive the dividend, which will be paid on the 19th of September.

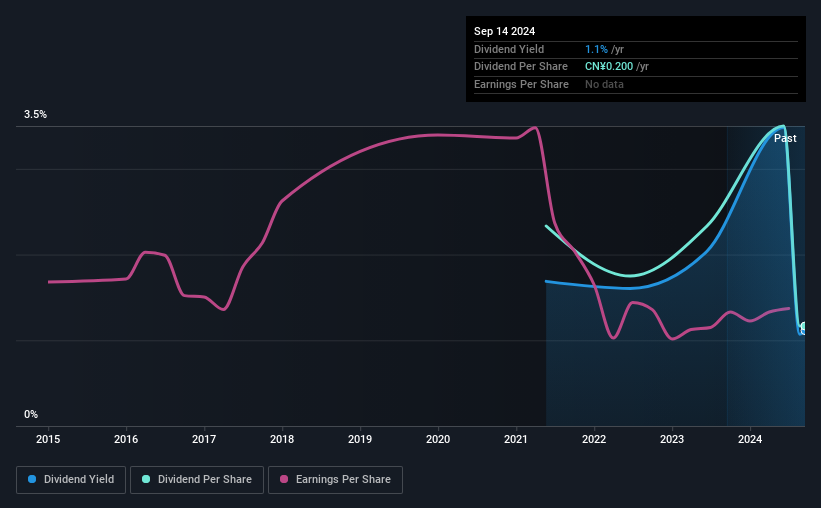

The company's next dividend payment will be CN¥0.10 per share. Last year, in total, the company distributed CN¥0.60 to shareholders. Last year's total dividend payments show that Shenzhen Tongye TechnologyLtd has a trailing yield of 1.1% on the current share price of CN¥17.97. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Shenzhen Tongye TechnologyLtd distributed an unsustainably high 179% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. A useful secondary check can be to evaluate whether Shenzhen Tongye TechnologyLtd generated enough free cash flow to afford its dividend. It paid out 83% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Shenzhen Tongye TechnologyLtd fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Shenzhen Tongye TechnologyLtd fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see how much of its profit Shenzhen Tongye TechnologyLtd paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're discomforted by Shenzhen Tongye TechnologyLtd's 17% per annum decline in earnings in the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Shenzhen Tongye TechnologyLtd has seen its dividend decline 21% per annum on average over the past three years, which is not great to see. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

Final Takeaway

Is Shenzhen Tongye TechnologyLtd worth buying for its dividend? Earnings per share have been in decline, which is not encouraging. Additionally, Shenzhen Tongye TechnologyLtd is paying out quite a high percentage of its earnings, and more than half its cash flow, so it's hard to evaluate whether the company is reinvesting enough in its business to improve its situation. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Shenzhen Tongye TechnologyLtd.

Although, if you're still interested in Shenzhen Tongye TechnologyLtd and want to know more, you'll find it very useful to know what risks this stock faces. For example, we've found 3 warning signs for Shenzhen Tongye TechnologyLtd (2 are concerning!) that deserve your attention before investing in the shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.