Unfortunately for some shareholders, the EC Healthcare (HKG:2138) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 74% loss during that time.

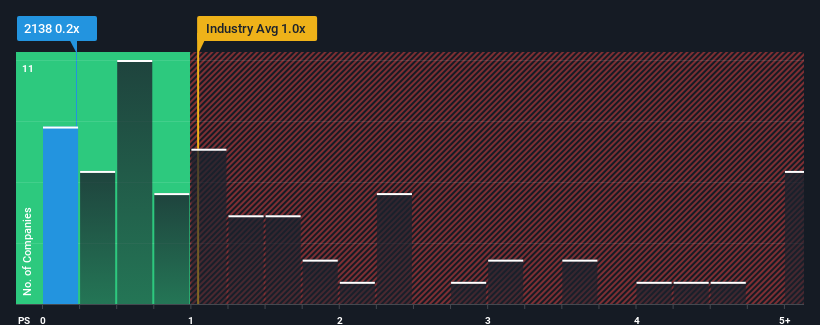

After such a large drop in price, when close to half the companies operating in Hong Kong's Consumer Services industry have price-to-sales ratios (or "P/S") above 1x, you may consider EC Healthcare as an enticing stock to check out with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does EC Healthcare's P/S Mean For Shareholders?

Recent times haven't been great for EC Healthcare as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think EC Healthcare's future stacks up against the industry? In that case, our free report is a great place to start.How Is EC Healthcare's Revenue Growth Trending?

In order to justify its P/S ratio, EC Healthcare would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, EC Healthcare would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 8.7% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 102% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 14% as estimated by the two analysts watching the company. With the industry predicted to deliver 19% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why EC Healthcare's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On EC Healthcare's P/S

The southerly movements of EC Healthcare's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of EC Healthcare's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - EC Healthcare has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on EC Healthcare, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.